Technical specification

| Technical Specification |

|---|

| CliSiTefI and CliSiTef Libraries |

| Version 248 |

Summary#

5 API - Routines available on CliSiTef [9]

5.1 Library configuration [11]

5.1.1 General special settings [12]

5.1.2 Additional Automation/Establishment information [13]

5.2 Start of Payment or Management transaction [17]

5.2.2 Function code table [21]

5.2.3 Additional Parameters [25]

5.3 Continuation of the iterative collection process [25]

5.3.2 Table of values for FieldType [32]

5.3.3 Event Table, also returned in FieldType [49]

5.4 Payment confirmation or not [51]

5.4.1 Completion of individual payments in the same tax coupon [52]

5.4.2 Completion of payments for a given network in the same tax coupon [52]

5.4.3 Attach data relating to payment methods for a transaction (NFPAG) [52]

5.5 Query transactions pending confirmation on the terminal [56]

5.5.1 Number of transactions pending confirmation on the terminal [56]

5.5.2 Query pending transactions on the terminal [58]

5.5.3 Query pending transactions in a specific tax document [58]

5.6.1 Set permanent message for the PinPad [59]

5.6.2 Reading track 3 of the card [59]

5.6.4 Card reading - secure capture routines [61]

5.6.6 Reading Confirmation by Customer on PinPad [66]

5.6.7 Sets a momentary message for the PinPad[67]

5.6.8 Reading special PinPad keys [68]

5.7 Banking Correspondent (Bill Payment) [69]

5.8 Checking the integrity of a barcode [70]

5.10 Sending pending messages [73]

5.12 Loading Tables on PinPad [75]

5.12.1 With changes in Automation [75]

5.12.2 No change to Automation[76]

6 CliSiTef.ini or CLSIT settings file [77]

6.1.2 Configuration when Automation does not use a pinpad [78]

6.1.3 Setting up a second pinpad [79]

6.1.4 Setting the default message [80]

6.1.5 Enabling value confirmation on the pinpad [80]

6.2 Connection configuration with the SiTef server [80]

6.2.1 Configuring additional IP addresses [80]

6.2.2 SiTef server port configuration [80]

6.2.3 Connection required [81]

6.2.4 Keeping connection active [81]

6.2.5 Communication display configuration [81]

6.2.6 Changing timing parameters (timeout) [81]

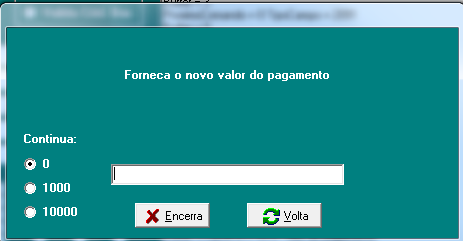

6.3 How to pass a new transaction purchase value on CliSiTef [82]

6.4 Enabling/disabling payment methods [84]

6.4.1 Restricting payment methods at runtime [84]

6.4.2 Setting default values for payment methods [84]

6.4.3 Enabling additional transactions [85]

6.4.4 Disabling transactions [86]

6.5 Enabling transactions from specific networks [86]

6.6 Table of payment method codes, settings and menus[88]

6.7 Enabling special settings per transaction [99]

6.8 Credit/debit transactions with card without BIN [102]

6.9 Enabling credit in installments when in a linked payment [105]

8.2 Directory configuration [108]

8.3 Trace files per terminal [109]

8.4.1 Enabling the rotating trace [110]

8.4.2 Limiting file sizes [111]

8.4.3 Sending trace files to the SiTef server [111]

9 Development/approval process [112]

9.1 Additional trace file during development phase [112]

11.1 Authorizing Network Code [114]

13 Discontinued routines [121]

Introduction#

The CliSiTefI and CliSiTef libraries provide developers with of commercial automation a set of routines (APIs) for integration with the SiTef server.

The SiTef server, in turn, offers a wide range of payments with the most diverse authorizers.

The CliSiTefI and CliSiTef libraries are available for a series of platforms, typically in the form of dynamic libraries.

It has entry points through which commercial automation configures, requests a payment, requests a management role or the payment of a bill.

The entry points are in CliSiTefI and this is what should be loaded by the user application.

CliSiTef is for the exclusive use of CliSiTefI and cannot be charged or called directly at risk of eventually destabilize the environment. In this document, any reference to CliSiTef should be understood as the set of these two libraries.

Target Audience#

Commercial automation developers with CliSiTef.

Goals#

Present a description of the library that interfaces with the payment method services available on SiTef.

Presentation#

CliSiTef provides a quick and simple way to make available SiTef functionalities for applications in general. Its main features are:

Non-intrusive as it is the automation itself that manages your screens. There is no overlapping of screens on the interface itself, which, if existed, most of the time it would not be compatible with the visual layout of the client's main application;

Allows the automation application to restrict transactions available for a given payment since, in practical life, negotiation takes place with the client and once the means of payment, number of installments, etc., must not be modified by mistake when executing the TEF;

Allows total freedom in the inclusion of new products and means of payment, following the evolution of SiTef, without the need make any changes to the automation or, if it is essential (for example through the inclusion of new access peripherals such as bar code reader), it should be kept to a minimum.

Note: CliSiTef has, for each functionality, two points of input (routines). The choice of which of the interfaces will be used by the application depends on the programmer's personal taste and whether the environment used by it for development imposes some type of restriction in the call to CliSiTef. In particular, we are referring to the type of data manipulated by the programming environment. If he only accepts data in ASCII, the interface called hereinafter referred to as "A" in this document.

Basic operation#

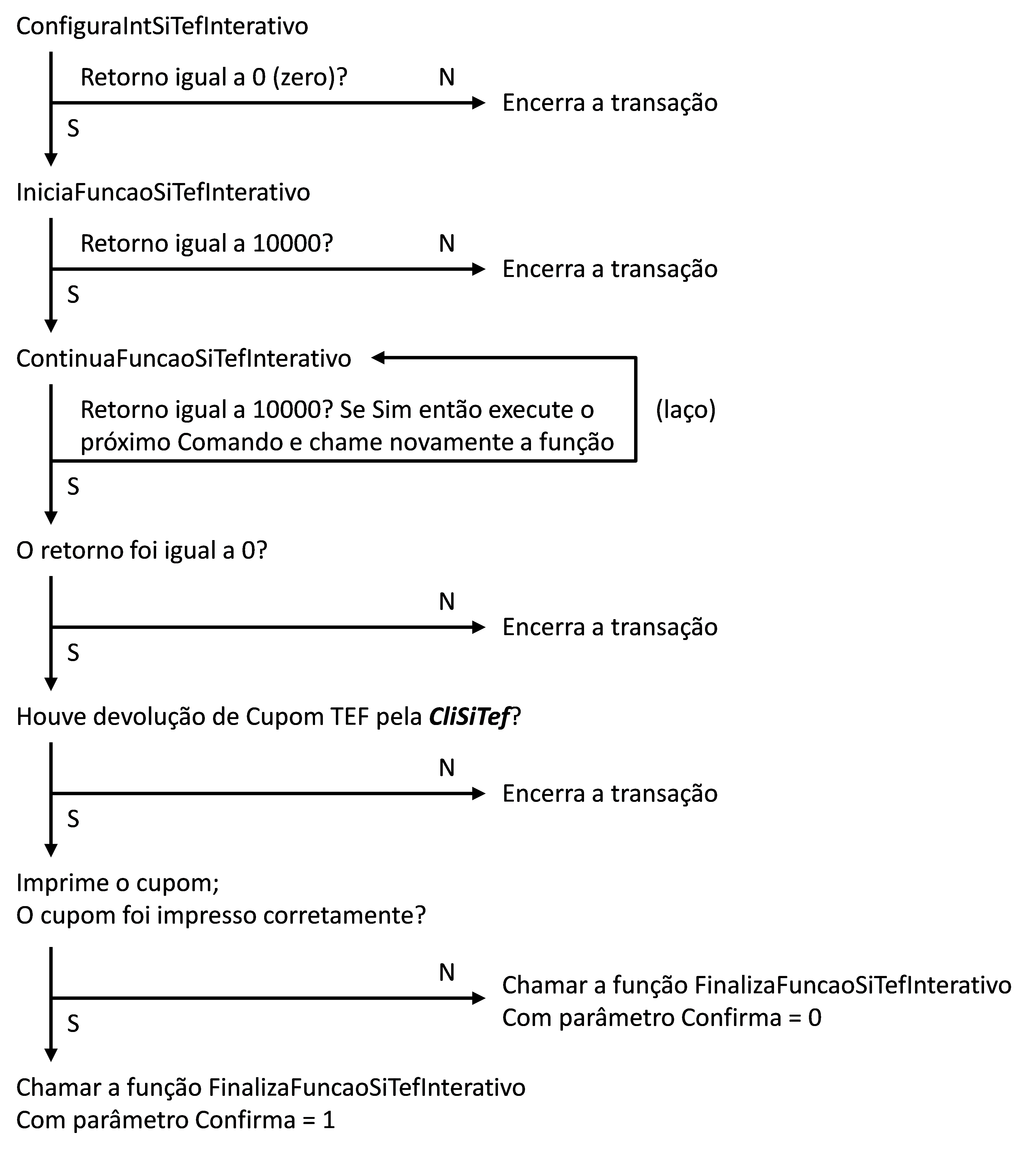

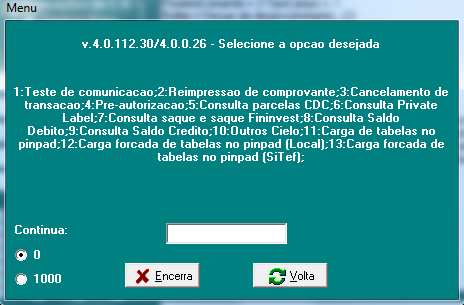

Initial step

Initially, Commercial Automation must execute the command ConfiguraIntSiTefInterativo, passing the necessary information to so that the Sales Terminal can communicate with SiTef, such as Address SiTef IP, Company Code (in SiTef Demo this code is 00000000) and the terminal identification.

This function should only be called when CliSiTef is

loaded i.e. it is not necessary to call it with each new transaction (unless there is a specific need to change

company parameters, terminal or SiTef server IP).

The routine returns a value indicating whether the configuration occurred with success or not. If 0 (zero) returns, the process occurred in a correct.

Transaction itself

The next step is then to call the IniciaFuncaoSiTefInterativo function, passing the described parameters to it.

Upon return, it returns the value 10000 to continue the transaction or other value to close.

If the return is 10000, you must call the function ContinuaFuncaoSiTefInterativo, with the parameters also described for her we next topics.

While CliSiTef returns the value when calling this function 10000, the automation must keep repeating the call to this function as many times as necessary until the return value of the function be 0 (zero), indicating that everything went well, or different from 0 and 10000 indicating that an abnormal interruption occurred.

Confirmation (or non-confirmation) of the transaction

If the return was 0 (zero), the automation closes the loop and if there was TEF coupon printing, the automation must print them and call another function, the FinalizaFuncaoSiTefInterativo, confirming or not the transaction depending, respectively, on whether the coupon was printed correctly or not.

If the return was different from 10000 and 0 then the automation simply exits the loop and, at the programmer's option, may or may not display a message according to the return of the called function. For example, if returned -2, it means that the transaction was canceled by the operator. These negative returns are described in this document.

Graphically exemplifying the flow described in this topic, we would have the Following:

API - Routines available on CliSiTef#

In this chapter, we will present the functions available in clisitef. For Therefore, the following conventions will be adopted:

Empty field or not provided -- in the standard version it is a field containing just the delimiter (binary zero). In the ASCII version, if it is a field fixed it contains spaces. If it is a variable field it only contains the start and end field delimiter.

Field size -- in the case of a fixed size field, when this value is provided, indicates the minimum size to be reserved by the application to receive a response from SiTef.

Type of function parameters -- we will divide into two groups:

1. Regarding the flow of information: the parameter can be input or output.

two. When passing: the parameter can be passed by value or by reference.

Each routine described in this chapter typically has two versions/interfaces:

Standard interface -- traditional, allows parameters with data binaries

ASCII Interface -- for interfacing with programming languages, whose parameters work only in ASCII.

What differentiates the ASCII version from the standard version is the addition of the suffix A in the name of the functions, and the way/type of passing the parameters.

Standard interface

This interface can be used by applications written in most variable programming languages that accept binary fields. Among We mention: Delphi, Visual Basic, Visual C.

In the case of receipts, the character 0x0a (\n in C language) indicates the end of a line.

All routines called by the automation application must be of type stdcall, i.e., the parameters are stacked from right to left left and the called routine is responsible for removing them from the stack. A Parameter convention is as follows:

Table 1: Parameter types and convention

| Type | Description |

|---|---|

| char * | ASCII text buffer terminated by binary zero. |

| short int (short), unsigned short int (ushort) | Variables that occupy 2 bytes in memory, with and without sign, respectively. |

| int, unsigned int (uint) | Variables that occupy 4 bytes in memory, with and without sign, respectively. |

| void | Indicates the absence of parameters or return. |

| <variable type> * (example: short int * or int *) | Indicates that the "variable type" variable is being passed as an address, that is, CliSiTef will use the automation application area to work, and may return some results there. |

ASCII interface

This interface can be used by applications written in any programming language, including those that do not accept fields binaries, such as Oracle's Forms environment.

In it all parameters are passed in ASCII and can be of size fixed and variable.

Numeric fields are always passed with a fixed size and aligned to right, with zeros on the left. In particular, the field whose content is a negative value, has a "-" sign in the leftmost position of the number (e.g.: -0001 for a 5-position field whose content is the value --1).

Variable length ones are constructed so that the first character indicate which value was chosen to be the delimiter of that field or That is, the field is delimited by the chosen character or its complementary in the case of the pairs "( )", "[ ]", "{ }" and "< >".

Examples of valid constructions are: (1234), [1234], {1234}, <1234>, \$1234\$, %1234%, |1234|, etc.

NOT VALID examples are as follows: $12$34$, .1,234.56., etc.

The criterion for choosing the delimiter must be that it does not exist as a valid character in the field in question. In data passes from application for CliSiTef, as they are always known, the application can define a default character and always use it in all data passes. In the return, as any character is valid (for example on a receipt), the above rule must be used in interpretation of the result returned by CliSiTef since this will choose the character that best adapts to the answer that is being generated.

Finally, there is a special character that is used in texts directed to a printer. The "\" (backslash) indicates the end of one line and must be used by the application to instruct the printer to close the current line and position yourself in the next one.

Library configuration#

This must be the first call to the CliSiTef library. She has The objective is to configure the connection parameters with the server SiTef, and with Commercial Automation itself.

int ConfiguraIntSiTefInterativo (IPSiTef, IdStore, IdTerminal, Reserved)

int ConfiguraIntSiTefInterativoEx (IPSiTef, IdStore, IdTerminal, Reserved, AdditionalParameters)

ASCII Interface

ConfiguraIntSiTefInterativoA (Result, IPSiTef, IdStore, IdTerminal, Reserved)

ConfiguraIntSiTefInterativoExA (Result, IPSiTef, IdStore, IdTerminal, Reserved, AdditionalParameters)

| Parameter | Type | Standard Interface | ASCII Interface | Description |

|---|---|---|---|---|

| Result | Output, by value | Not used | Fixed 6 | Contains the result of the response to the routine call. |

| IPSiTef | Entry, by value | char * | Variable | Configures the name or IP address (in "." notation) of the SiTef server. |

| IDStore | Entry, by value | char * | Fixed 8 | Identifies the store number within the network of commercial establishments. |

| IdTerminal | Entry, by value | char * | Fixed 8 | Identifies the POS in front of the store. It has the format XXnnnnnn where XX corresponds to 2 alphabetic characters and nnnnnn to any 6 digits as long as the resulting number does not overlap the range 000900 to 000999 which is reserved for use by SiTef. |

| Reserved | Entry, by value | char * | Fixed 6 | Must be passed with 0 |

| AdditionalParameters | Entry, by value | char * | Variable | Additional CliSiTef configuration parameters in the following format: [<Parameter_Name_1>=<Parameter_Value_1>;<Parameter_Name_2>=<Parameter_Value_2>] |

Important!

Each terminal must have a unique and fixed code per SiTef store. In this way, the commercial establishment must manage the codes used in such a way that there is never a repetition of terminals for a same store.

The SiTef server does not allow two or more simultaneous connections using the same pair (store, terminal), dropping the connections previous ones, keeping only the last connection made; if perhaps the transaction that was in progress when the POS connection dropped duplicate was already in pending status (a sale for example), the SiTef immediately places it in Canc.POS status (Cancelled by the POS), or In other words, this will be cancelled; the terminal that is disconnected will receive the message "No SiTef connection" with error code -5.

When the commercial establishment uses Pinpad to read cards and password entry and if the pair (store, terminal) is changed, this will result in new tables being loaded onto the pinpad every change. This is yet another reason for the terminal code to be fixed.

The configuration routines return one of the following values:

Table 2 - Return codes from configuration functions

| Value | Description |

|---|---|

| 0 | No error occurred |

| 1 | Invalid or unresolved IP address |

| 2 | Invalid store code |

| 3 | Invalid terminal code |

| 6 | Tcp/Ip initialization error |

| 7 | Lack of memory |

| 8 | Didn't find CliSiTef or it has problems |

| 9 | SiTef server configuration has been exceeded. |

| 10 | Access error in the CliSiTef folder (possible lack of writing permission) |

| 11 | Invalid data passed through automation. |

| 12 | Safe mode not active (possible lack of configuration on the SiTef server of the .cha file). |

| 13 | Invalid DLL path (the full library path is too long). |

Note: during the automation lifecycle, if there is no change in the function's input parameters, then there is no need to call her again.

General special settings#

Certain general settings (valid for all transactions) of the CliSiTef can be passed through the parameter "ParametrosAdicionais" from the routine ConfiguraIntSiTefInterativoEx. O Format of this field is as follows:

[<Functionality>;<Functionality>;...]

Next, we describe the functionalities provided in this field.

Note: in this item only the settings will be highlighted main. For a detailed description of all available options, see the document "CliSiTef -- Lista de Parâmetros Adicionais".

| Functionality | Description |

|---|---|

| MultipleCoupons=1 | Indicates that the POS is able to receive more than one receipt per transaction. In the case of transactions with more than one receipt, such as cell phone recharge transactions or bill payments with credit or debit cards, the cell phone recharge or bill payment receipt will be delivered separately from the credit or debit EFT receipt. |

| PinPad Port=<PinPad Port> | Defines the port to which the shared pinpad is connected. Example: |

| Windows: [PortaPinPad=1] | |

| Linux: [PortaPinPad=/dev/ttyS0] | |

| LojaECF=<Num Loja> | Tax store number (Maximum size: 20) |

| CaixaECF=<Num Caixa> | Tax box number (Maximum size: 20) |

| NumberSeriesECF=<Series ECF> | ECF Serial Number (Max Size: 20) |

Additional Automation/Establishment information#

The ParmsClient configuration allows commercial automation to configure information common to all transactions exchanged with the SiTef server.

Format:

[ParmsClient=Id1=Value1;Id2=Value2;Id3=Value3;...;IdN=ValueN]

where:

<ParmsClient=> = Data identifier prefix.

<IdN> = Field identifier, as defined in the table below.

<ValueN> = Field value.

Id Format Meaning

1 CNPJ number of the establishment/store.

2 CNPJ number of the company that developed the automation commercial.

3 CPF number of the establishment/store

4 Numeric CNPJ Facilitator (Van)

Table 3 Field codes available for ParmsClient.

Example of how to send data to CliSiTef:

[ParmsClient=1=31406434895111;2=12523654185985]

Where:

- 1 (CNPJ of the Establishment) with the value 31406434895111.

- 2 (CNPJ of the commercial automation company) with the value 12523654185985.

Note: This parameter should not be used for sub-acquiring (soft descriptor). For this purpose, please refer to the document "CliSiTef - Sub-Acquiring Information (Soft Descriptor)"

Floating point#

How automation tells CliSiTef that it knows how to handle fields with dots floating

Treating fields with Floating Point requires a procedure executed in conjunction with automation.

For Clisitef to carry out this procedure, which will be described below, it is necessary for the automation to inform Clisitef that it is capable of treat it. To do this, the automation must pass the string below into the "ParametrosAdicionais" parameter when executing the function ConfiguraIntSiTefInterativoEx.

[TrataPontoFlutuante=1]

If this parameter is omitted and SiTef requests field collection with Floating Point, CliSiTef will ask the automation to display the message: "Ponto Flutuante nao Suportado pelo PDV".

Procedure in "married operation" with automation

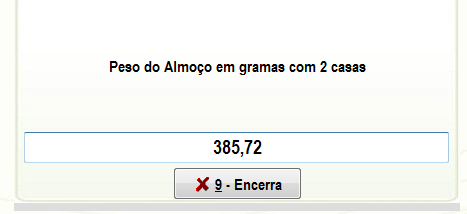

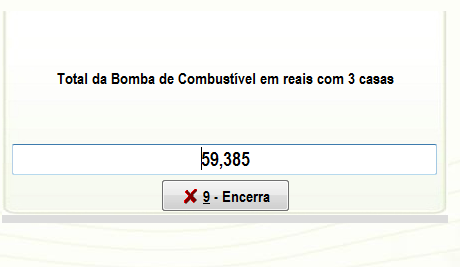

If informed in the Configuration, support the Floating Point feature, as described above, CliSiTef through Command 0 in conjunction with o Field Type 2470, informs Automation of the number of decimal places in the Buffer parameter, so that it can format its screens before display them to the operator (See Screen Examples on the next page). Only after this "pact" with Automation, CliSiTef will send the command field collection with floating point (through commands 34 or 30) as per examples below.

Parameters ContinueFunctionSiTefInteractive CliSiTef =========> POS

| Command | FieldType |

|---|---|

| 0 | 2470 |

| Examples of number of decimal places | Buffer |

|---|---|

| Lunch weight in grams with 2 boxes | 2 |

| Total Fuel Pump in reais with 3 houses | 3 |

• In the example where the number of decimal places reported was 2, then Afterwards, CliSitef will request command 30:

• In the example where the number of decimal places reported was 3, then Afterwards, CliSitef will request command 34:

Start of Payment or Management transaction#

The following routines are recommended for starting a transaction in CliSiTef.

What differentiates the transaction to be executed is the Function code passed by parameter. (See Table 5.2.2)

The various transactions initiated by commercial automation are grouped by fiscal data, which is the pair (TaxCoupon, TaxDate) and With this data, controls on pending transactions are carried out. confirmations from CliSiTef.

HoraFiscal is important for security validations of some pinpad manufacturers (in order to prevent attacks and fraud).

int IniciaFuncaoSiTefInterativo (Function, Value, TaxCoupon, TaxDate, TaxTime, Operator, ParamAdic)

ASCII Interface

IniciaFuncaoSiTefInterativoA (Result, Function, Value, TaxCoupon, TaxDate, TaxTime, Operator, ParamAdic)

The functions below were used for Self-Service terminals, and are considered obsolete.

int IniciaFuncaoAASiTefInterativo (Function, Value, TaxCoupon, TaxDate, TaxTime, Operator, ParamAdic, Products)

ASCII Interface

IniciaFuncaoAASiTefInterativoA (Result, Function, Value, CouponTax, TaxDate, TaxTime, Operator, ParamAdic, Products)

| Parameter | Type | Standard interface | ASCII Interface | Description |

|---|---|---|---|---|

| Result | Output, by value | Not used | Fixed 6 | Contains the result of the response to the routine call. |

| Function | Entry, by value | int | Fixed 6 | Select the payment method, according to the “Function Codes” table below. |

| Value | Entry, by value | char * | Variable | Contains the amount to be paid containing the decimal separator (“,”). It must always be passed with two decimal places after the comma (“,”). If the operation does not have a value defined a priori (e.g. prepaid recharge), this field must be empty. |

| TaxCoupon | Entry, by value | char * | Max 20 | Tax Coupon Number corresponding to the sale It is important that the tax coupon number is always increasing (increased with each transaction), as the entire process of controlling pending transactions and CliSiTef confirmations is based on the CouponFiscal + DataFiscal set. |

| TaxDate | Entry, by value | char * | Fixed 8 | Tax Date in YYYYMMDD format |

| TaxTime | Entry, by value | char * | Fixed 6 | Fiscal Schedule in HHMMSS format |

| Operator | Entry, by value | char * | Max 20 | Identification of the cashier |

| ParamAdic | Entry, by value | char * | Variable | Additional parameters. Allows the application to limit the type of payment method. It is optional and can be passed empty. When this field is used, CliSiTef will limit the navigation menus only to codes not present in the list. See item 5 for the description of the internal format of this field |

| Products | Entry, by value | char * | Variable | Contains the list of products that the customer is purchasing at the Self-Service terminal. It is mandatory as these products will form an integral part of the Tef operation receipt to be printed. The basic format of this field is: [<Description1>;<Code1>;<Quantity1>;<TotalValue1>]; [<Description2>;<Code2>;<Quantity2>;<Total Value2>];... It must be repeated as many times as the number of different products purchased by the customer. |

IMPORTANT: This routine only starts the payment process. If the return is 10000 the payment process must be continued through the routine ContinuaFuncaoSiTefInterativo or ContinuaFuncaoSiTefInterativoA until the latter returns a final result (see item that describes this function).

IMPORTANT: up to version 6.1.114.39 (inclusive) of clisitef, whenever a payment is initiated on a new tax document (a pair <TaxCoupon, TaxDate> different from the previous one), the transaction data previous will be replaced by those of the newly started one, making it impossible that some treatments, such as pending issues, are carried out successfully.

Therefore, all necessary treatments must be resolved before starting a new transaction.

From version 6.1.114.40 (inclusive), CliSiTef allows you to start a new payment, without deleting any outstanding issues from the tax document previous.

Return code table#

| Value | Description |

|---|---|

| 0 | Successful execution of the function. |

| 10000 | The process continuity routine must be called. |

| other positive value | Denied by authorizer. |

| -1 | Module not initialized. The POS tried to call some routine without first executing the configure function. |

| -2 | Operation canceled by operator. |

| -3 | The function / modality parameter is non-existent/invalid. |

| -4 | Lack of memory in the POS. |

| -5 | No communication with SiTef. |

| -6 | Operation canceled by user (on pinpad). |

| -7 | Reserved |

| -8 | CliSiTef does not have the necessary function implementation, it is probably outdated (CliSiTefI is more recent). |

| -9 | The automation called the routine ContinuaFuncaoSiTefInterativo without first starting an iterative function. |

| -10 | Some mandatory parameter was not passed by commercial automation. |

| -12 | Error executing the iterative routine. Probably the previous iterative process was not executed until the end (while the return is equal to 10000). |

| -13 | Tax document not found in CliSiTef records. Returned in query functions such as ObtemQuantidadeTransaçõesPendentes. |

| -15 | Operation canceled by commercial automation. |

| -20 | Invalid parameter passed to the function. |

| -21 | Used a prohibited word, for example PASSWORD, to collect open data on the pinpad. For example in the ObtemDadoPinpadDiretoEx function. |

| -25 | Banking Correspondent Error: Bloodletting must be carried out. |

| -30 | File access error. Make sure that the user running the application has read/write rights. |

| -40 | Transaction denied by SiTef server. |

| -41 | Invalid data. |

| -42 | Reserved |

| -43 | Problem executing any of the routines on the pinpad. |

| -50 | Unsecured transaction. |

| -100 | Internal module error. |

| other negative value | Errors detected internally by the routine. |

Function code table*#

The following codes are available to be used in the parameter Function described above1.

| Function | Description |

|---|---|

| 0 | Generic payment. CliSiTef allows the operator to choose the payment method through menus. |

| 1 | Check |

| 2 | Debt |

| 3 | Credit |

| 4 | Fininvest |

| 5 | Benefit Card |

| 6 | Centralized Credit |

| 7 | Fuel Card |

| 8 | Pay More Redecard |

| 10 | Wappa Meal Benefit |

| 11 | Wappa Food Benefit |

| 12 | Infocard Card |

| 13 | Pay Pass |

| 15 | Sale with Gift Card |

| 16 | Debit for payment of booklet |

| 17 | Credit for payment of booklet |

| 28 | Sale with Quality Card (ICI Card) |

| 100 | Telemarketing: Initiates collection of transaction data at the point needed to handle an entered credit card transaction |

| 101 | Cancellation of sales with a Quality card (ICI Card) |

| 110 | Open the Management transactions menu |

| 111 | Communication test with SiTef |

| 112 | Reprint Menu |

| 113 | Re-print specific voucher |

| 114 | Reprint last receipt |

| 115 | Pre-authorization |

| 116 | Pre-authorization capture |

| 117 | Pre-authorization adjustment |

| 118 | Pre-authorization consultation |

| 130 | Querying pending transactions on the terminal |

| 131 | Querying pending transactions in a specific tax document |

| 150 | Bonus Consultation |

| 151 | Gift Card Balance Inquiry |

| 152 | Gift Card Balance Inquiry |

| 160 | EMS Card Inquiries |

| 161 | EMS Card Sales |

| 200 | Normal Cancellation: Starts data collection at the point necessary to cancel a debit or credit transaction, without having to first go through the administrative transactions menu |

| 201 | Telemarketing Cancellation: Similar to modality 200 but for the function of canceling entered credit transactions |

| 202 | Pre-authorization Cancellation |

| 203 | Cancellation of Pre-Authorization Capture |

| 210 | Cancellation of sales with Credit Card |

| 211 | Cancellation of sales with Debit card |

| 212 | Cancellation of sales with Fuel card |

| 213 | Cancellation of Sale with Gift Card |

| 250 | Bonus Consultation Cancellation |

| 251 | Gift Card Recharge Cancellation |

| 253 | Cancellation Accumulation of Bonus Card Points |

| 254 | Redeem Bonus Card Points |

| 255 | Cancellation of Bonus Card Points Redemption |

| 256 | Accumulation of Bonus Card Points |

| 257 | Gift Card Recharge Cancellation |

| 264 | Gift Card Recharge |

| 265 | Activation Linked Payment Gift Card |

| 266 | Gift Card Consultation |

| 267 | Gift Card Activation Without Payment |

| 268 | Gift Card Activation With Payment |

| 269 | Gift Card Unlinked Activation |

| 310 | Bank Correspondence (Bill Payment) |

| 311 | Payment of Bills with Withdrawal |

| 312 | Consultation for Unlinked Payment (Generic) |

| 313 | Unlinked Payment (Generic) |

| 314 | Corban SE Prepaid Recharge with Withdrawal |

| 315 | Withdrawal for Payment |

| 316 | Unlinked payment cancellation (generic) |

| 317 | Consult Banking Correspondent Limits |

| 318 | Bradesco Prepaid Recharge |

| 319 | Bradesco Prepaid Recharge disconnected from payment |

| 320 | Corban SE Prepaid Recharge |

| 321 | Corban SE Prepaid Recharge disconnected from payment |

| 322 | Identified Deposit |

| 323 | Transfer between Accounts |

| 324 | Pay Easy |

| 325 | INSS Password Revalidation |

| 350 | Sell Product (No Value) |

| 351 | Cancellation of Product Sale (No Value) |

| 400 | Vale-Gas |

| 401 | Vale-Gás Validation |

| 410 | Surprise Change |

| 422 | Insurance Membership |

| 430 | Le Cartão Seguro (LeCartaoSeguro) |

| 431 | Le Trilha Chip (LeTrilhaChipInterativoEx) |

| 500 | ACSP Detailed Query |

| 501 | Serasa Detailed Consultation |

| 600 | Balance Inquiry |

| 601 | Debit Card Balance Inquiry |

| 602 | Credit Card Balance Inquiry |

| 657 | Withdraw Credit Transfer |

| 658 | Withdraw Credit |

| 660 | IBI Withdrawal Menu |

| 661 | IBI Bank Withdrawal Consultation |

| 662 | IBI Bank Withdrawal |

| 663 | GetNet Withdrawal |

| 664 | GetNet Withdrawal Cancellation |

| 665 | Points Redemption |

| 667 | Points Issuance |

| 668 | Cancellation of Point Issuance |

| 669 | Prepaid Load |

| 670 | Prepaid Load Cancellation |

| 671 | Withdrawal Consultation with IBI Banco Withdrawal |

| 672 | IBI Bank Withdrawal Cancellation |

| 680 | Prepaid Balance Inquiry |

| 698 | Debit Withdrawal |

| 700 | Sale Hi Paggo |

| 701 | Hi Paggo Cancellation |

| 702 | Bill payment |

| 703 | Benefit Card Payment Cancellation |

| 705 | Invoice Payment |

| 740 | Adm Credit Installments Consultation |

| 770 | Loading tables on pinpad 2 |

| 771 | Forced loading of tables on pinpad (Local) |

| 772 | Forced loading of tables on the pinpad (SiTef) |

| 775 | Getting Pinpad Information 3 |

| 899 | Credit card recharge |

| 900 | Credit card top-up cancellation |

| 913 | Change of Pre-Authorization |

| 928 | Debit Cancellation for Payment Carnet Forced Network |

| 943 | Invoice payment without linked invoice |

| 944 | Invoice payment without unlinked invoice |

| 999 | Closure |

| 1000 | Paper Voucher |

Additional Parameters#

Additional parameters, valid for the current transaction, can be passed to CliSiTef through the ParamAdic parameter of the routine IniciaFuncaoSiTefInterativo and its variants.

To meet the need for some "Authorizing" networks, which require information about the Electronic Tax Document issued by "Commercial Automations", 2 "functionalities" were defined to pass the necessary data in the ParamAdic parameter (see details in item Enabling special settings per transaction).

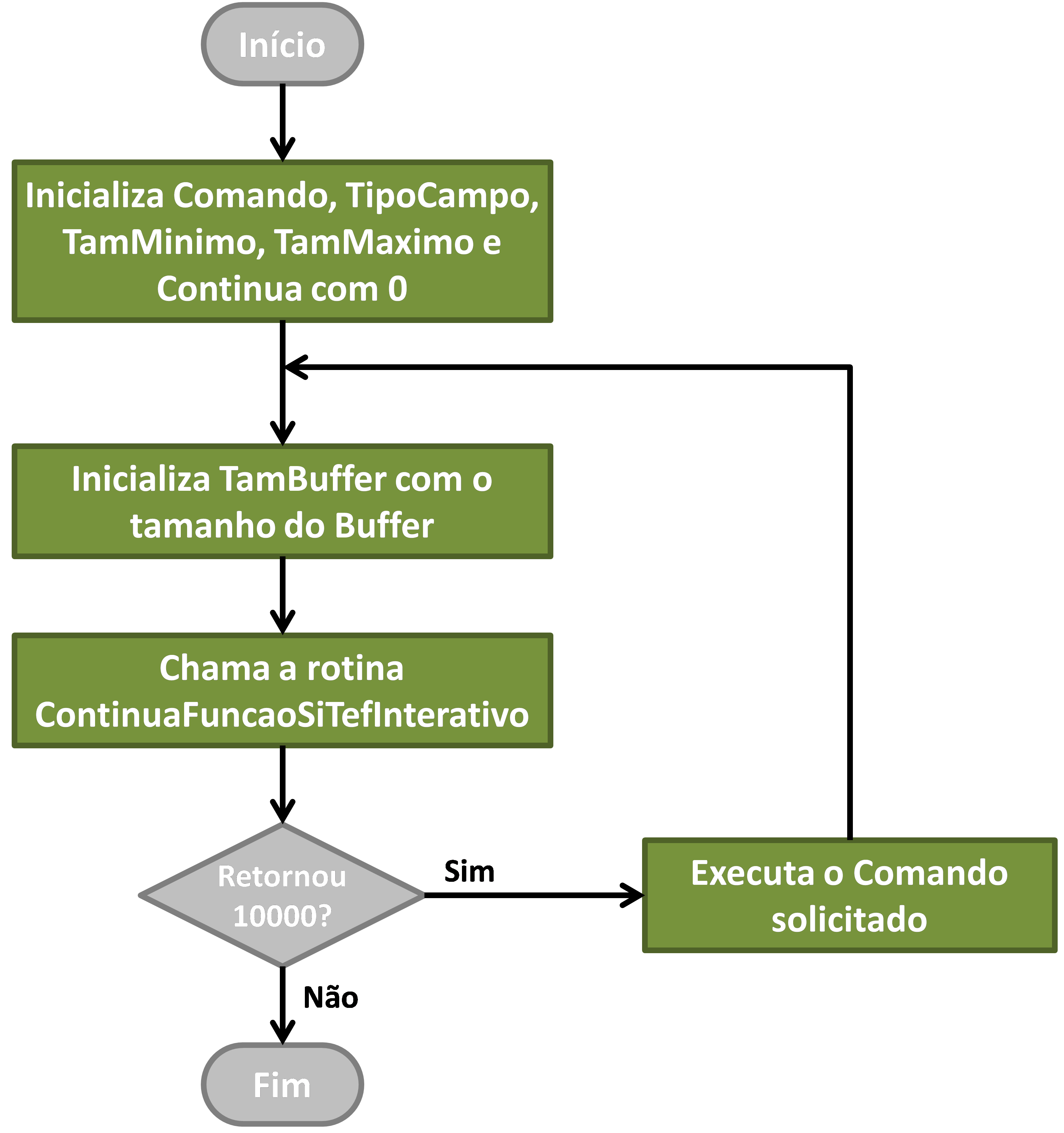

Continuation of the iterative collection process#

This function must be called continuously until there are no more information to be exchanged between the application and CliSiTef (this is, as long as its return is equal to 10000), as described in results returned by it. The activation format is as follows:

int ContinuaFuncaoSiTefInterativo (Command, FieldType, MinimumSize, MaximumSize, Buffer, TamBuffer, Continues)

ASCII Interface

ContinueFunctionSiTefInterativoA (Result, Command, FieldType, MinimumSize, MaximumSize, Buffer, TamBuffer, Continues)

| Parameter | Type | Standard interface | ASCII Interface | Description |

|---|---|---|---|---|

| Result | Output, by value | Not used | Fixed 6 | Contains the result of the response to the routine call. |

| Command | Output, by reference | int * | Fixed 12 | Contains in the return: 0 → if CliSiTef is returning any data relating to the transaction in the Buffer field <> 0 → indicates the Next Command to be executed by the application. Valid commands are described in Command Code Table |

| FieldType | Output, by reference | long * | Fixed 12 | Contains the code for the type of field that the automation should handle. The existing types are described in Table of values for FieldType |

| MinimumSize | Output, by reference | short * | Fixed 6 | When the Command is a data collection, it contains the Minimum size of the field to be read |

| MaximumSize | Output, by reference | short * | Fixed 6 | When the Command is a data collection, it contains the Maximum size of the field to be read |

| Buffer | Entry and Exit, by value | char * | Variable | Data transfer area between the application and CliSiTef. It must be at least 20,000 bytes. If automation is not sending data to CliSiTef, this field must be passed empty |

| TamBuffer | Entry, by value | int | Fixed 6 | Size of the area reserved by automation for the Buffer field |

| Continued | Entry, by value | int | Fixed 6 | Contains instructions for CliSiTef regarding the Command executed according to the following coding: |

| 0 → Continue transaction | ||||

| 1 → Returns, when possible, the collection to the previous field | ||||

| 2 → Cancels the current bill payment, keeping previous ones in memory, if any, allowing such payments to be sent to SiTef and even allowing new payments to be included. Return valid only on collections of amounts and due date of a bill payment. | ||||

| 10000 → Transaction continues, see note below | ||||

| -1 → Closes the transaction |

Note: As the field requested by the routine does not always need to be read in the At the time of the request, the routine accepts the value 10000 to indicate that the field was not collected at that time but previously, in the moment of closing the sale.

A typical example of this situation occurs when the automation has already closed with the customer a form of payment in installments using a credit card. In this If automation can, at the moment field collection is requested to read the number of installments, then return the previously agreed number without capture this user data.

Note that in this form of use it is essential that the data is presented to the operator who must confirm its veracity before It is routine to return it to CliSiTef.

Also note that this form of use is not mandatory, and the Automation always capture screen data. Use of this feature may change the collection flow or any rule defined by the flags, so before using them, consult the Software Express Support department who will verify the need prior authorization by the flags.

Upon return, the routine returns the same values as the Payment routine. In addition to these values, the function returns the value 0 (Zero) to indicate that the requested function was completed successfully (e.g. if is a payment, it was approved by the administrator).

It is important to point out that the call that starts the iterative process (the one that is made after the value 10000 has been received in the call of a Payment, Management function, etc...) must be done with Command, FieldType, MinimumSize, MaximumSize and Continues containing the value 0 (zero).

Also note that commercial automation must be in a loop calling the routine described here until she receives a result different from 10000 or the automation itself stops continuing the process, as shown below:

If the automation wants to close the collection process, it must, necessarily call the routine ContinuaFuncaoSiTefInterativo passing --1 (minus one) in the Continue field. If the process of collection should continue, it should not modify any of the fields filled by CliSiTef except for the Buffer which, in the new call, must contain the collection result (if Command different from 0) or the original data if Command came with 0. Note also that even if the Buffer contains a field collected by automation, its size must be recommended by this document as it will contain, upon return, new data provided by the routine.

Note that the Buffer field may have been filled in by the routine with some data to be memorized, displayed on the display or for another reason, according to what is specified in the description of each command that the automation application must handle.

IMPORTANT: It is mandatory that the automation ALWAYS collect fields not treatable by her, that is, if she receives some code in pinpad error

that she is unaware of or does not wish to treat, that the information is captured by the operator typing the requested information.

Command code table#

Below we present the possible values for the parameter Command and the action that the application should perform upon receiving it. It is important that the commercial automation handles all commands in this table.

| Command | Description |

|---|---|

| 0 | It is returning a value to, if desired, be stored by the automation |

| 1 | Message for operator display |

| 2 | Message for the customer display |

| 3 | Message for both displays |

| 4 | Text that should be used as title in the menu presentation (see command 21) |

| 11 | You must remove the message displayed on the operator display (command 1) |

| 12 | You must remove the message displayed on the customer's display (command 2) |

| 13 | Must remove message displayed on operator and customer displays (command 3) |

| 14 | You must clear the text used as title in the menu presentation (command 4) |

| 15 | Header to be displayed by the application. Refers to the display of additional information that some transactions need to show on the screen. |

| An example is the Bank Correspondent Loan transaction, which at a certain point requires information to be shown to the customer detailing the loan being contracted (such as Installment amount, due date, etc.). | |

| 16 | You must remove the header presented by command 15. |

| 20 | You must present the text in Buffer, and obtain a YES/NO answer. |

| In the return, the first character present in Buffer must contain 0 if confirmed and 1 if cancelled. | |

| 21 | It should present a menu of options and allow the user to select one of them. |

| In the call, the Buffer parameter contains options in the format 1:text;2:text;...i:Text;... | |

| The application routine must present the options in the way it wishes (it is not necessary to include the indices 1,2, ...). | |

| After the selection made by the user, return the index i chosen by the operator in Buffer (in ASCII) | |

| 22 | You must display the message in Buffer, and wait for a key from the operator. It is used when you want the operator to be notified of a message displayed on the screen. |

| 23 | This command indicates that the routine is asking the application whether it wants to interrupt the data collection process or not. This code occurs when CliSiTef is accessing some peripheral and allows the automation to interrupt this access (for example: waiting for a card to be passed through the reader or for the customer to enter a password) |

| Note: It is important that the “Commercial Automation Application” does not place “delays” when handling this command. At this point, some device (pinpad, barcode reader...) is carrying out some processing (reading card/barcode, collecting password) and a “delay” causes delays in accessing data from the device, which may not be more available, resulting in data loss and communication errors. | |

| 29 | Analogous to command 30, however, a field must be collected that does not require intervention from the cashier, that is, it does not need to be typed/shown on the screen, but rather passed directly to the library by automation. |

| An example is the payment methods that some transactions require to identify which type of payment is being used. | |

| The value to be collected refers to the field indicated in FieldType, whose size is between Minimum Size and Maximum Size. The field must be returned in Buffer. | |

| 30 | A field whose size is between Minimum Size and Maximum Size must be read. The read field must be returned in Buffer. |

| 31 | The number of a check must be read. Collection can be done by reading the CMC-7, typing the CMC-7 or typing the first line of the check. |

| On return, it must be returned in Buffer: | |

| “0:”(typing the first line of the check), | |

| “1:”(CMC-7 reading) or | |

| “2:”(CMC-7 Typing), | |

| followed by the number collected manually or by reading/typing the CMC-7, respectively. | |

| When the first line of the check is collected manually, the format is as follows: Clearing (3), Bank (3), Agency (4), C1 (1), Current Account (10), C2 (1), Account Number Check (6) and C3 (1), in that order. Note that these fields are those at the top of a check and in the order presented. | |

| We suggest that an interface be presented during the collection that allows the operator to identify and properly enter this information so that the query is not made with incorrect data, returning a check with problems as good. | |

| 34 | A monetary field must be read, that is, it accepts the cent delimiter and returned in the Buffer parameter. |

| 35 | A bar code must be read or collected manually. |

| The Buffer return must contain “0:” or “1:” followed by the barcode collected manually or by the reader, respectively. | |

| It is up to the application to decide whether the collection will be manual or through a reader. If manual collection is required, it is recommended to follow the procedure described in the ValidaCampoCodigoEmBarras[1] routine in order to treat a bar code in the most generic way possible, leaving the automation application independent of future changes that may arise in the bar formats. | |

| When returning from Buffer, “2:” can also be passed, indicating that the collection was canceled, but the flow will not be interrupted, so in the case of multiple payments, all documents previously collected will be maintained and the flow will be resumed, allowing making such payments. | |

| 41 | Analogous to Command 30, but the field must be collected in a masked way. |

| 42 | Menu identified. It should present a menu of options and allow the user to select one of them. |

| In the call, the Buffer parameter contains options in the format class | |

| The application routine must present the options in the way it wishes (it is not necessary to include the indexes 1,2, ..., nor field codes, type and class) and after the selection made by the user, return in Buffer the index i chosen by the operator (in ASCII). | |

| The option code is the identification (Table of payment method codes, settings and menus) of the option field, it can be used to identify the chosen option. | |

| Within each “class” there is coding of “types”, and each pair (class, type) indicates the nature of the option. Initially, only identification for payment methods was implemented. The idea is to add codes that identify menu options to enable the POS to identify these options without the operator's assistance. | |

| · Classes: | |

| o 0: Class not defined | |

| o 1: Payment method, types below: | |

| § 1: Money | |

| § 2: Check | |

| § 3: Debit | |

| § 4: Credit | |

| § 5: Loot | |

| § 6: Another way | |

| The other menus are not identified. Unidentified menus receive a zero value in these fields, indicating that there has not yet been a need to classify them. | |

| Option classes are intended to define a context for which the code that identifies the type of option is determined. Thus, an option in the menu is always identified based on the option type and option class pair. | |

| This command is used when the additional parameter ItemMenuIdentificado is used (Enabling special configurations). In this case, command 21 (menu collection) will be replaced in most cases, and the application must be prepared to handle both commands when this parameter is enabled. |

Table of values for FieldType#

Below we present the possible values for the field TipoCampo and respective meanings5:

Fields marked with * indicate that they are used in one or more products.

Note that not all fields are returned in all transactions. In addition Furthermore, there are fields that are only returned if the transaction was approved.

The automation application must ignore those fields that do not wish/do not know how to treat since, in future versions of CliSiTef, new fields may be made available. Note that the correct way to ignoring these fields is executing the function defined in NextCommand or simply ignore the data returned to the application when NextCommand is 0.

Commercial automation is responsible for storing receipts for printing at the appropriate time, in accordance with current Tax legislation.

In the case of Banking Correspondent or Functions Administrative, any receipt must be printed at the moment they are made available for automation and information whether they were printed correctly or not is passed through the function ContinuaFuncaoSiTefInterativo through the value 0 or -1, respectively, placed in Continue.

| FieldType | Description |

|---|---|

| -1 | There is no information that can/should be handled by automation |

| 0 | The routine is being called to indicate that it has just collected the transaction data and will start interacting with SiTef to obtain authorization |

| 1 | Transaction confirmation data. For environments with multiple servers, it will be returned in the following format: |

| <Data_Confirmation>;<Index_SiTef>;<Address_SiTef> | |

| 2 | Informs the SiTef function code used in the message sent to the server. |

| 10 to 99 | Informs which option is selected in the transaction navigation menu, following the same coding used to define payment restrictions described in the item Restricting or enabling payment methods. |

| and | |

| 3000 to 3999 | |

| 100 | Payment method in xxnn format. |

| xx corresponds to the modality group and nn to the subgroup. | |

| Group: | |

| · 00: Check | |

| · 01: Debit Card | |

| · 02: Credit Card | |

| · 03: Voucher card | |

| · 05: Loyalty Card | |

| · 98: Money | |

| · 99: Another type of card | |

| Subgroup: | |

| · 00: In sight | |

| · 01: Pre-dated | |

| · 02: Installments with financing by the establishment | |

| · 03: Installments with financing by the administrator | |

| · 04: Cash with interest | |

| · 05: Credit | |

| · 99: Other type of payment | |

| 101 | Contains the actual text of the payment method that can be memorized by the application if necessary. Describe in full the xxnn pair given in 100 |

| 102 | Contains the descriptive text of the payment method that must be printed on the tax coupon (e.g.: T.E.F., Check, etc...) |

| 105 | Contains the date and time of the transaction in the format AAAAMMDDHHMMSS |

| 110 | Returns when a transaction is cancelled. Contains the cancellation modality in the xxnn format, following the same xxnn format as TipoCampo 100. The nn sub-group, however, contains the default value 00 as it is not collected. |

| 111 | Contains the actual text of the cancellation method that can be memorized by the application if necessary. Describes in full the xxnn pair given in 110. |

| 112 | Contains the descriptive text of the cancellation method that must be printed on the tax coupon (e.g.: T.E.F., Check, etc...). |

| 115 | Adjustment mode |

| 120 | Buffer contains the check authentication line to be printed on the back of the check |

| 121 | Buffer contains the first copy of the payment receipt (customer copy) to be printed on the fiscal printer. This copy, when possible, is reduced so that it takes up few lines on the printer. It can be a sales or administrative receipt |

| 122 | Buffer contains the second copy of the payment receipt (cash copy) to be printed on the fiscal printer. It can be a sales or administrative receipt |

| 123 | Indicates that the receipts that will be delivered next are of a certain type: |

| · PROOF_PURCHASES = "00" | |

| · VOUCHER_VOUCHER = "01" | |

| · PROOF_CHEQUE = "02" | |

| · PROOF_PAYMENT = "03" | |

| · PROOF_MANAGERIAL = "04" | |

| · PROOF_CB = "05" | |

| · RECEIPT_RECHARGE_CELL PHONE = "06" | |

| · RECEIPT_RECHARGE_BONUS = "07" | |

| · RECEIPT_RECHARGE_GIFT = "08" | |

| · PROOF_RECHARGE_SP_TRANS = "09" | |

| · PROOF_MEDICATIONS = "10" | |

| 125 | Voucher Code |

| 130 | Indicates, upon collection, that the field in question is the value of the cash change to be returned to the customer. When returning the result (Command = 0) it contains the value actually approved for the change |

| 131 | Contains an index that indicates which institution will process the transaction according to the table at the end of the document (up to 5 significant digits) |

| 132 | Contains an index that indicates the type of card when that type is identifiable, according to a table to be provided (5 positions) |

| 133 | Contains the SiTef NSU (6 positions) |

| 134 | Contains the NSU of the authorizing Host (20 positions maximum) |

| 135 | Contains the Authorization Code for credit transactions (15 positions maximum) |

| 136 | Contains the first 6 positions on the card (bin) |

| 137 | Balance payable |

| 138 | Total Amount Received |

| 139 | Entry Value |

| 140 | Date of first installment in ddmmyyy format |

| 143 | Tip amount |

| 144 | Refund value |

| 145 | Payment amount |

| 146 | The routine is being called to read the Value to be canceled. If the automation application has this value, it can present it to the operator and allow him to confirm the value before passing it back to the routine. If it does not have this value, you must read it. |

| 147 | Amount to be canceled |

| 150 | Contains Track 1, when available, obtained from the LeCartaoInterativo function |

| 151 | Contains Track 2, when available, obtained from the LeCartaoInterativo function |

| 153 | Contains the customer's password captured through the LeSenhaInterativo routine and the customized Software Express security lib must be passed to the commercial establishment in order to obtain the open password |

| 154 | Contains the new payment amount |

| 155 | Bonus card type |

| 156 | Name of institution |

| 157 | Establishment Code |

| 158 | Authorizing Network Code |

| 160 | Original coupon number |

| 161 | Payment Coupon Identification Number |

| This is a counter (starting with value 0) of payments that occurred on the coupon. | |

| Example: If there were 6 payments in the Coupon, the values returned will be from [0] to [5]. | |

| 170 | Installation Sale of Qualified Establishment |

| 171 | Minimum Number of Installments – Establishment Installments |

| 172 | Maximum Number of Installments – Establishment Installments |

| 173 | Minimum Value Per Installment – Establishment Installments |

| 174 | Sell in Installments Qualified Administrator |

| 175 | Minimum Number of Installments – Administrative Installments |

| 176 | Maximum Number of Installments – Administrative Installments |

| 177 | Indicates that the field is numeric (PBM) |

| 178 | Indicates that the field is alphanumeric (PBM) |

| 200 | Available balance*, balance of the specific product (school, transport voucher) |

| 201 | Blocked Balance |

| 500 | Indicates that the field in question is the supervisor's code. Automation can, if desired, validate the collected data, allowing the transaction flow to continue normally if an acceptable supervisor is present. |

| 501 | Type of Document to be consulted (0 – CPF, 1 – CGC) |

| 502 | Document number (CPF or CGC) |

| 504 | Service Fee |

| 505 | Number of Installments |

| 506 | Pre-dated date in ddmmyyy format |

| 507 | Captures whether the first installment is in cash or not (0 – First in cash, 1 – otherwise) |

| 508 | Interval in days between installments |

| 509 | Captures whether it is a closed month (0) or not (1) |

| 510 | Capture whether it is with (0) or without (1) post-dated guarantee with debit card |

| 511 | Number of CDC Installments |

| 512 | Credit Card Number Entered |

| 513 | Card expiration date |

| 514 | Card security code |

| 515 | Transaction date to be canceled (DDMMYYY) or to be reprinted |

| 516 | Document number to be canceled or reprinted |

| 517 | The routine is being called to read the Check Number as described in the type of command corresponding to value 31 |

| 518 | Item Code |

| 519 | Payment Plan Code |

| 520 | NSU from SiTef Original (Cisa) |

| 521 | Identification document number (RG) |

| 522 | The routine is being called to read the Phone Number |

| 523 | The routine is being called to read the area code of a telephone with up to 4 digits |

| 524 | Value of the first installment |

| 525 | Value of other installments |

| 526 | Number of checks |

| 527 | Check due date |

| 529 | The routine is being called to read the Account Opening Date in the format (MMAAAA) |

| 530 | Supervisor authorization entered |

| 531 | Special supervisor authorization |

| 532 | The routine is being called to read the number of installments or checks |

| 533 | Additional sales data |

| 534 | Check issuer |

| 535 | The document paid for the transaction |

| 536 | CDL-Poa check consultation return records |

| 537 | Area code of the city of the check |

| 550 | Address |

| 551 | Address number |

| 552 | Floor of address |

| 553 | Address set |

| 554 | Address block |

| 555 | Address zip code |

| 556 | Address neighborhood |

| 557 | CPF for AVS consultation |

| 558 | AVS query result |

| 559 | Number of days of pre-dating |

| 560 | Number of Cycles |

| 561 | Occurrence Code |

| 562 | Store Code (EMS) |

| 563 | POS Code (EMS) |

| 564 | Data Returned (EMS) |

| 565 | Telephone Extension |

| 566 | RG Issuing Body |

| 567 | State where the ID was issued |

| 568 | RG dispatch date |

| 569 | Operator Registration |

| 570 | Operator Name |

| 571 | Lecturer's Registration |

| 572 | Name of Lecturer |

| 573 | Percentage of Interest Applied |

| 574 | Authorizer Registration |

| 575 | Original Transaction Tax Coupon Date |

| 576 | Original Transaction Tax Coupon Time |

| 577 | Carnet details or EMS summary code |

| 578 | Differentiated mile code 1 |

| 579 | Value of differentiated miles 1 |

| 580 | Differentiated mile code 2 |

| 581 | Value of differentiated miles 2 |

| 582 | EMS external code type |

| 583 | EMS external code |

| 587 | Code name of the cell phone authorizing institution |

| 588 | Cell phone authorization establishment code |

| 593 | Check digit(s) |

| 594 | Zip code of the location where the terminal in which the operation is being carried out is located |

| 595 | Obsolete. SiTef NSU corresponding to the Recharge payment transaction with card |

| 596 | Obsolete. Nsu of the Authorizing Host corresponding to the Recharge payment transaction by card |

| 597 | Code of the Branch that responded to the cell phone recharge request |

| 599 | Cell phone recharge authorizing network code |

| 600 | Title/agreement expiration date in DDMMAAAA format |

| 601 | Amount Paid* |

| 602 | Original Value |

| 603 | Additional Value |

| 604 | Rebate Value |

| 605 | Payment Accounting Date |

| 606 | Name of the Assignor of the Title. It must be printed on the check when payment is made via this method |

| 607 | Document index, in the case of batch payment, of fields 600 to 604 that will follow |

| 608 | Payment method used in the banking correspondent role. Follows the same formatting rule as the number 100 field |

| 609 | Total value of titles actually paid in case of batch payment |

| 610 | Total value of unpaid titles in case of batch payment |

| 611 | NSU Banking Correspondent |

| 612 | Document type: 0 - Collection, 1 - Title (Compensation form), 2 - Tax |

| 613 | Contains the details of the check used to pay bills in the following format: Clearing (3), Bank (3), Agency (4), Current Account (10), and Check Number (6), in that order. Note that the order is the same as that on the top line of the check without the check digits |

| 614 | NSU SiTef payment transaction |

| 620 | NSU SiTef of original transaction (cancellation transaction) |

| 621 | NSU Bank Correspondent of the original transaction (cancellation transaction) |

| 622 | Benefit Value |

| 623 | Code printed at the bottom of the CB receipt and used for re-printing/cancellation |

| 624 | Paid barcode. Appears once for each document index (field 607). The format is the same as that used to enter the field, that is, 0:number or 1:number |

| 625 | Withdrawal receipt |

| 626 | Bank number |

| 627 | Agency |

| 628 | Agency digit |

| 629 | Account |

| 630 | Account digit |

| 631 | Money value |

| 632 | Amount by check |

| 633 | Name of depositor |

| 634 | Original Banking Correspondent Document |

| 635 | User key used to communicate with the Bank |

| 636 | Unique sequence of the user's key in the Bank |

| 637 | Code of the correspondent's store relationship agency |

| 638 | CB Check Number |

| 639 | Invoice Number |

| 640 | Agreement Number |

| 641 | Statement Start Date (DDMMAAAA) |

| 642 | Statement End Date (DDMMAAAA) |

| 643 | Calculation Period |

| 644 | Federal Revenue Code |

| 645 | Value of Gross Revenue |

| 646 | Applied Percentage |

| 647 | Main Value |

| 648 | Fine Value |

| 649 | Interest Value |

| 670 | PinPad Data |

| 700 | ValeGás Operator |

| 701 | ValeGás Product |

| 702 | ValeGás number |

| 703 | Reference Number |

| 704 | GPS code |

| 705 | GPS Competence |

| 706 | Contributor Identifier |

| 707 | INSS Value |

| 708 | Value Other Entities |

| 709 | Allows Payment of Bills With Cash (0 – Does not allow; 1 – Allows) |

| 710 | Allows Payment of Bills by Check (0 – Does not allow; 1 – Allows) |

| 711 | Allows Payment of Bills with TEF Debit (0 – Does not allow; 1 – Allows) |

| 712 | Allows Bill Payment With TEF Credit (0 – Does not allow; 1 – Allows) |

| 713 | Payment Methods used in the Generic Payment transaction |

| 714 | Withdrawal Value |

| 715 | Order Number |

| 716 | CB Deposit Limit Value |

| 717 | CB Withdrawal Limit Value |

| 718 | Withdrawal Limit Value for CB Payment |

| 719 | Value of the ValeGás product |

| 722 | Minimum payment amount |

| 723 | Customer Identification, for Carrefour receipt only |

| 724 | Sell Credit in Installments with Plan Enabled |

| 725 | Sell Credit with Qualified Cash Authorization |

| 726 | Sell Credit with Installment Authorization with Enabled Plan |

| 727 | Bill Sale Enabled |

| 729 | Maximum payment amount |

| 730 | Maximum number of payment methods, 0 for no limit |

| 731 | Payment Type Enabled, repeats “n” times, where “n” is the number of payment methods enabled: |

| · 00 Money | |

| · 01 Check | |

| · 02 TEF Debit | |

| · 03 TEF Credit | |

| · 04 Carrefour Gift Card (Prepaid) | |

| · 05 Carrefour Bonus Card | |

| · 06 Carrefour Card | |

| · 07 Withdrawal for payment | |

| · 08 Withdrawal | |

| · 09 DCC Carrefour | |

| · 50 TEF Card | |

| · 77 Reserved Field | |

| 732 | Data to be sent for the Payment Type (Field 730) previously returned, repeats “n” times, where “n” is the number of data to be sent for the respective Payment Type: |

| · 00 Reserved Field | |

| · 01 Check Entry Type | |

| · 02 Check Details | |

| · 03 Destination Network | |

| · 04 SiTef NSU of the TEF transaction | |

| · 05 SiTef date of the TEF transaction (unused, future use) | |

| · 06 Company (Store) Code of the EFT transaction | |

| · 07 TEF Transaction Host NSU | |

| · 08 TEF transaction Host Date (Field 105 CliSiTef) | |

| · 09 Origin Code (Establishment) of the TEF transaction | |

| · 10 Service Z of the EFT transaction | |

| · 11 EFT Transaction Authorization Code | |

| · 12 Check Amount | |

| 734 | Minimum sales limit for flexible promotions, with 12 digits with the last 2 digits referring to decimal places |

| 738 | Suggested value for the selected product. |

| 739 | Preferred Customer |

| 750 | Pay Easy Value CB |

| 751 | Pague Fácil CB Fare Value |

| from 800 to 849 | The entire range from 800 to 849 is reserved for the return of GerPdv |

| 950 | CNPJ NFCE Accreditor |

| 951 | NFCE Flag |

| 952 | NFCE authorization number |

| 953 | SAT Accreditation Code |

| 1002 | Card Expiration Date |

| 1003 | Cardholder Name |

| 1010 | Quantity of medicines - PBM |

| 1011 | Drug index – PBM |

| 1012 | Medication code – PBM |

| 1013 | Authorized quantity – PBM |

| 1014 | Maximum consumer price – PBM |

| 1015 | Recommended consumer price – PBM |

| 1016 | Pharmacy sales price – PBM |

| 1017 | Refund value at the pharmacy – PBM |

| 1018 | Replacement value at the pharmacy – PBM |

| 1019 | Subsidy value of the agreement – PBM |

| 1020 | CNPJ agreement – PBM |

| 1021 | Discount plan code – PBM |

| 1022 | Does have a prescription – PBM |

| 1023 | CRM – PBM |

| 1024 | UF – PBM |

| 1025 | Product description* - PBM |

| 1026 | Product code – PBM |

| 1027 | Product quantity – PBM |

| 1028 | Product value – PBM |

| 1029 | Date of medical prescription - PBM |

| 1030 | PBM authorization code |

| 1031 | Quantity reversed – PBM |

| 1032 | PBM chargeback code |

| 1033 | Recommended cash consumer price – PBM |

| 1034 | Recommended price consumed for payroll deduction – PBM |

| 1035 | Pharmacy replenishment percentage – PBM |

| 1036 | Replacement commission – PBM |

| 1037 | Authorization Type – PBM |

| 1038 | Partner code – PBM |

| 1039 | Name of partner – PBM |

| 1040 | Type of PBM Medicine (01–Medicine, 02-Handling, 03-Special Handling, 04-Perfumery) |

| 1041 | Medicine Description – PBM |

| 1042 | Condition for sale: If 0 mandatory, use Functional Card (PF) price |

| If 1 can sell for a price lower than the PF price | |

| 1043 | Functional price card |

| 1044 | Price charged – PBM |

| 1045 | Drug status – PBM |

| 1046 | Amount prescribed – PBM |

| 1047 | Reference – PBM |

| 1048 | PBM sales indicator (0-Product sold by card 1-Product sold in cash) |

| 1051 | Date of birth |

| 1052 | Mother's name |

| 1058 | Additional data – ACSP |

| 1100 | Analytical record CHECKCHECK |

| 1101 | ACSP analytical record |

| 1102 | SERASA analytical record |

| 1103 | ACSP analytical screen image |

| 1104 | SERASA analytical screen image |

| 1105 | Reason for cancellation – ACSP |

| 1106 | Query type – ACSP |

| 1107 | CNPJ Affiliated Company |

| 1108 | Administrator code |

| 1109 | Telecheque table data - ACSP |

| 1110 | Driver registration – Fuel Card |

| 1111 | Vehicle plate – Fuel Card |

| 1112 | Mileage – Fuel Card |

| 1113 | Quantity of liters – Fuel Card |

| 1114 | Main fuel – Fuel Card |

| 1115 | Fuel products – Fuel Card |

| 1116 | Host Product Code – Fuel Card |

| 1117 | Hour Meter – Fuel Card |

| 1118 | Credit Line – Fuel Card |

| 1119 | Type of Goods – Fuel Card |

| 1120 | Branch – Fuel Card |

| 1121 | Decimal places of unit prices – Fuel Card |

| 1122 | Maximum quantity of products for sale |

| 1123 | Product code size – Fuel Card |

| 1124 | Vehicle code – Fuel Card |

| 1125 | Company Name – Fuel Card |

| 1126 | Decimal places of quantity – Fuel Card |

| 1128 | List of Questions – Fuel Card |

| 1129 | Allows Product Collection – Fuel Card |

| 1131 | Limit Code |

| 1132 | Number of Holders |

| 1133 | Company Opening Date (DDMMAAAA) |

| 1134 | Name of Holder |

| 1135 | Address Complement |

| 1136 | City |

| 1137 | State |

| 1152 | Value Menu - SPTrans |

| 1160 | Product with Face Value – Gift |

| 1190 | Issue (last 4 digits) of the Card |

| 1200 | Total previous consultations |

| 1201 | Accumulated value from previous queries, containing 2 decimal digits but without the decimal character. |

| 1202 | Total number of consultations carried out on the day. |

| 1203 | Accumulated value of consultations on the day, containing 2 decimal digits but without the decimal character. |

| 1204 | Total number of post-dated check consultations carried out in the period. |

| 1205 | Accumulated value of post-dated checks, containing 2 decimal digits but without the decimal character. |

| 1206 | Seller (User) - PBM |

| 1207 | Password – PBM |

| 1208 | Return Code – PBM |

| 1209 | Origin – PBM |

| 1321 | NSU of Canceled Transaction Authorizing Host |

| 2006 | Type of encryption |

| 2007 | MasterKey Index |

| 2008 | Encryption key |

| 2009 | Card password |

| 2010 | Authorizer response code |

| 2011 | Network bin |

| 2012 | CHIP serial number |

| 2013 | CHIP control record |

| 2014 | Common balance, common pass balance |

| 2015 | Gift card PAN |

| 2017 | First due date |

| 2018 | Total value |

| 2019 | Amount financed |

| 2020 | Percentage fine |

| 2047 | Default interest |

| 2048 | TAC (Administration fee) |

| 2053 | Menu (product) selected Visanet |

| 2054 | CDC Credit Type (1 – CDC Product; 2 – CDC Service) |

| 2055 | Date/Time Sitef (Location) |

| 2056 | Day of the week Sitef (Local) |

| 2057 | Sitef Date/Time (GMT) |

| 2058 | Sitef Day of the Week (GMT) |

| 2059 | Payment Method Data - SPTrans |

| 2064 | Cash payment amount |

| 2065 | Check query code (Generic EMS) |

| 2067 | Authorizer message to be displayed along with the values menu (If the terminal allows it) |

| 2078 | Service code |

| 2079 | Service value |

| 2081 | Product Menu |

| 2082 | Our number |

| 2083 | Total value of the product containing the decimal separator (“,”) and two decimal places after the comma. |

| 2086 | Product Code - ValeGas |

| 2087 | Deadline statement: 0: No; 1: Yes |

| 2088 | Total/Partial Cancellation: 0: Partial; 1: Total |

| 2089 | Invoice identification number. |

| 2090 | Card type Read: |

| · 00 – Magnetic (Traditional magnetic cards and Samsung Pay in “MST – Magnetic Secure Transmission” mode) | |

| · 01 - VISA Cash currency exchanger on TIBC v1 | |

| · 02 - VISA Cash currency exchanger on TIBC v3 | |

| · 03 - EMV with contact | |

| · 04 - Easy-Entry on TIBC v1 | |

| · 05 - Contactless chip simulating stripe | |

| · 06 - Contactless EMV (Traditional cards, contactless stickers and bracelets, in addition to mobile solutions such as Apple Pay, Google Pay, Samsung Pay in “NFC – Near Field Communication” mode, among others) | |

| · 99 – Typed | |

| 2091 | Status of last card reading |

| · 0 - Success. | |

| · 1 - Error subject to fallback. | |

| · 2 - Application required not supported. | |

| 2093 | Attendant code |

| 2103 | Indicates whether it was an offline transaction: 1: Yes |

| 2109 | Temporary password |

| 2124 | Cellphone Recharge fee value (via Banking Correspondent. Example: CB Bradesco) |

| 2125 | Plot number (2 characters) (Hotcard) |

| 2126 | Transaction sequence (6 characters) (Hotcard) |

| 2301 | Footer of proof of establishment copy |

| 2320 | Depositor Code – CB |

| 2321 | Customer Code |

| 2322 | Card Sequence – CB |

| 2323 | Via Card - CB |

| 2324 | Extract Type – CB |

| 2325 | Transfer limit value - CB |

| 2326 | Limit value for collecting CPF/CNPJ – CB |

| 2327 | Owner’s CPF/CNPJ – CB |

| 2328 | CPF/CNPJ of the Bearer – CB |

| 2329 | Type of Owner's document - CB |

| 2330 | Type of Bearer document - CB |

| 2331 | Indicates whether payment by CB card is allowed |

| 2332 | Transfer Value |

| 2333 | Transaction identification |

| 2334 | Pin Code |

| 2355 | When returned, it acts as a “hint” for the format of the next field that will be collected. It is normally accompanied by the zero command (0 – return value for use by automation). |

| Assumes the following values: | |

| · The Alphabetical | |

| · AN Alphanumeric (ans) | |

| · LN Unaccented letters and numbers | |

| · N Numeric | |

| · Vx Value with x decimal places | |

| · Y Yes/No | |

| · M Menu | |

| · Mc Menu with confirmation | |

| It is not a field that is returned in all field collections, only in situations that must be addressed in the specific document for each network. | |

| 2361 | Indicates that a debit transaction was carried out to pay the carnet |

| 2362 | Returned right after the bin query transaction. The value 1 indicates that the authorizer is able to treat conventional debit transactions differently from debit transactions for bill payments. |

| 2363 | Indicates that a credit transaction was carried out to pay the carnet |

| 2364 | Returned right after the bin query transaction. The value 1 indicates that the authorizer is capable of treating conventional credit transactions differently from credit for bill payment. |

| 2369 | Points to be redeemed (numeric without decimal place). |

| 2421 | Informs whether the additional customer data collection function is enabled (0 or 1) |

| 2467 | Date in DDMMAA Format Positive Confirmation |

| 2468 | Date in DDMM Format Positive Confirmation |

| 2469 | Date in MMAA Format Positive Confirmation |

| 2470 | Floating Point Field |

| 2601 | Message for pinpad |

| 2602 | Hash Seed |

| 2603 | Mode for card reading using function 431. |

| 2699 | Sends additional GIFT Activation/Recharge information, returned by the SQCF host, to Automation |

| 2925 | Credit Card Recharge Amount |

| 2965 | Debit Card Recharge Amount |

| 2974 | Sell in Installments via Qualified Credit |

| 2975 | Minimum number of installments for credit |

| 2976 | Maximum number of installments for credit |

| 3481 | Menu (managerial) AVS Query |

| 3988 | Credit Menu |

| 3989 | Credit Simulation Menu |

| 4000 | Pre-Authorization Status – PBM |

| 4001 | CRF – PBM |

| 4002 | UF of CRF – PBM |

| 4003 | Type of sale – PBM |

| 4004 | Total PBM value |

| 4005 | PBM cash value |

| 4006 | PBM card value |

| 4007 | Our PBM numbers |

| 4008 | Percentage of discount granted by the administrator (2 decimal places) |

| 4016 | Gross price – PBM |

| 4017 | Net price – PBM |

| 4018 | Amount receivable from the Store, in cents – PBM |

| 4019 | Batch number generated by Central – PBM |

| 4020 | Total amount receivable from the store – PBM |

| 4021 | Total amount receivable from the store – PBM |

| 4022 | Sum of Operation values – PBM |

| 4023 | Operator name – PBM |

| 4024 | Name of partner company – PBM |

| 4025 | Number of dependents – PBM |

| 4026 | Dependent code – PBM |

| 4027 | Dependent’s name – PBM |

| 4028 | Amount receivable from the partner – PBM |

| 4029 | Total discount value, in cents |

| 4030 | Total net value, in cents - PBM |

| 4031 | PBM Selected Operator Code (must be recorded for later sending in other transactions) |

| 4032 | Free data return field relating to PBM transactions. |

| 4033 | PBM document type (0 = CRM, 1 = CRO) |

| 4034 | Redemption Data - Bonus |

| 4039 | PBM Response Code (0 = Ok, <>0 = error) |

| 4040 | PBM Fractional Product (0 = no, 1 = yes) |

| 4041 | Patient ID PBM (-1 = others, 00 = holder, 01 = dependent) |

| 4043 | PBM ID Revenue (revenue registered by the company) |

| 4044 | Revenue item ID PBM (revenue item registered by the company) |

| 4045 | Recipe for continuous use (0 = no, 1 = yes) |

| 4046 | PBM Manipulated Product (active ingredients) |

| 4047 | PBM Manipulated Product Original Value |

| 4058 | Approved Product Value with Discount |

| 4076 | Store Identification |

| 4077 | Contains the FEPAS NSU (20 positions maximum) |

| 4095 | CPF/CNPJ of the Beneficiary |

| 4096 | CPF/CNPJ of the Sacador |

| 4097 | Payer's CPF/CNPJ |

| 4100 | Communication error (for example: timeout) The Buffer contains the Error code. |

| Examples: | |

| [TCP:R:10054] An existing connection was forced to be canceled by the remote host. | |

| [TCP:C:10060:TO] A connection attempt failed because the connected component did not respond correctly after a period of time | |

| or the established connection failed because the connected host did not respond. | |

| 4125 | Customer Coupon available, for reprinting or consultation, in the SiTef database |

| 4126 | Establishment Coupon available, for reprinting or consultation, in the SiTef database |

| 4127 | Number of days that coupons will be available in the SiTef database |

Event Table, also returned in TypeField#

During the transaction, CliSiTef may report the occurrence of certain events. These events are returned in the FieldType parameter of the ContinuaFuncaoSiTefInterativo or ContinuaFuncaoSiTefInterativoA routine, as shown in the table below.

| FieldType | Description |

|---|---|

| 5000 | Indicates that the library is waiting to read a card |

| 5001 | Indicates that the library is waiting for the user to enter the password |

| 5002 | Indicates that the library is waiting for the user to enter positive confirmation data |

| 5003 | Indicates that the library is waiting to read the single ticket |

| 5004 | Indicates that the library is waiting for the single ticket to be removed |

| 5005 | Indicates that the transaction has been completed |

| 5006 | Confirm Payee Data |

| 5007 | SiTef Connected |

| 5008 | SiTef Connecting |

| 5009 | Query OK |

| 5010 | Signature Harvest |

| 5011 | New Product Collection |

| 5012 | Confirm Operation |

| 5013 | Confirm Cancellation |

| 5014 | Confirm Total Value |

| 5015 | Single Ticket Recharge Completion |

| 5016 | Reserved |

| 5017 | Waiting for card reading |

| 5018 | Waiting to enter password on PinPad |

| 5019 | Waiting for chip processing |

| 5020 | Waiting for card removal |

| 5021 | Waiting for confirmation of operation |

| 5027 | Canceling card reading |

| 5028 | Canceling password entry on PinPad |

| 5029 | Cancelation of card processing with CHIP |

| 5030 | Card removal cancellation |

| 5031 | Operation confirmation cancellation |

| 5036 | Before reading the magnetic card |

| 5037 | Before reading the CHIP card |

| 5038 | Before removing the CHIP card |

| 5039 | Before collecting the password on the pinpad |

| 5040 | Before opening communication with the PinPad |

| 5041 | Before closing communication with the PinPad |

| 5042 | Should block resources for PinPad |

| 5043 | Must release resources for PinPad |

| 5044 | After opening communication with PinPad |

| 5049 | Timeout with SiTef |

| 5050 | Update of tables for offline transactions. |

| The content of this field varies depending on the transaction being carried out. | |

| 5051 | Indicates that you have collected a password on the pinpad. |

| 5052 | Indicates that it processed a chip card (GoOnChip) |