Continuation of the iterative collection process

This function must be called continuously until there is no more information to be exchanged between the application and CliSiTef (that is, as long as its return is equal to 10000), as described in the returned results for her. The activation format is as follows:

ASCII interface#

| Parameter | Type | Standard interface | ASCII Interface | Description |

|---|---|---|---|---|

| Result | Output please | Not used | Fixed 6 | Contains the result of the response to the routine call. |

| Command | Output, by reference | int * | Fixed 6 | Contains in return: 0 → if CliSiTef is returning any data relating to the transaction in the Buffer field 0 → indicates the Next Command to be executed by the application. Valid commands are described in Command Code Table |

| FieldType | Output, by reference | const * | Fixed 6 | Contains the code of the type of field that the automation should handle. The existing types are described in Table of values for CampType |

| Minimum Size | Output, by reference | short * | Fixed 6 | When the Command is a data collection, it contains the Minimum and Maximum size of the field to be read |

| Maximum Size | Output, by reference | short * | Fixed 6 | When the Command is a data collection, it contains the Minimum and Maximum size of the field to be read |

| Buffer | Input and Output, by value | char * | Variable | Data transfer area between the application and CliSiTef. It must be at least 20,000 bytes. If automation is not sending data to CliSiTef, this field must be passed empty |

| TamBuffer | Input, by value | int | Fixed 6 | Size of the area reserved by the automation for the Buffer field |

| Continues | Input, by value | int | Fixed 6 | Contains instructions for CliSiTef regarding the Command executed according to the following coding: 0 → Continues the transaction 1 → Returns, when possible, the collection to the previous field 2 → Cancels the current bill payment, keeping previous ones in memory, if any, allowing such payments to be sent for SiTef and even allows you to include new payments. Return valid only on collections of amounts and due date of a bill payment. 10000 → Continue the transaction, see the following note -1 → Close the transaction |

Note: As the field requested by the routine does not always need to be read when the routine is requested accepts the value 10000 to indicate that the field was not collected at that moment but rather previously, in the moment of closing the sale.

A typical example of this situation occurs when the automation has already agreed a payment method with the customer. paid in installments by credit card. In this case, automation can, at the moment field collection is requested, to read the number of installments, return the previously agreed number without capturing this user data.

Note that in this form of use it is essential that the data is presented to the operator who must confirm its veracity before the routine returns it to CliSiTef.

Also note that this form of use is not mandatory, and automation can always capture data from the screen. Using this feature may change the collection flow or any rule defined by the flags, so Before using it, consult the Software Express Support department who will check the need for prior authorization by the flags.

Upon return, the routine returns the same values as the Payment routine. In addition to these values, the function returns the value 0 (Zero) to indicate that the requested function was completed successfully (e.g. if it is a payment, it was approved by the administrator).

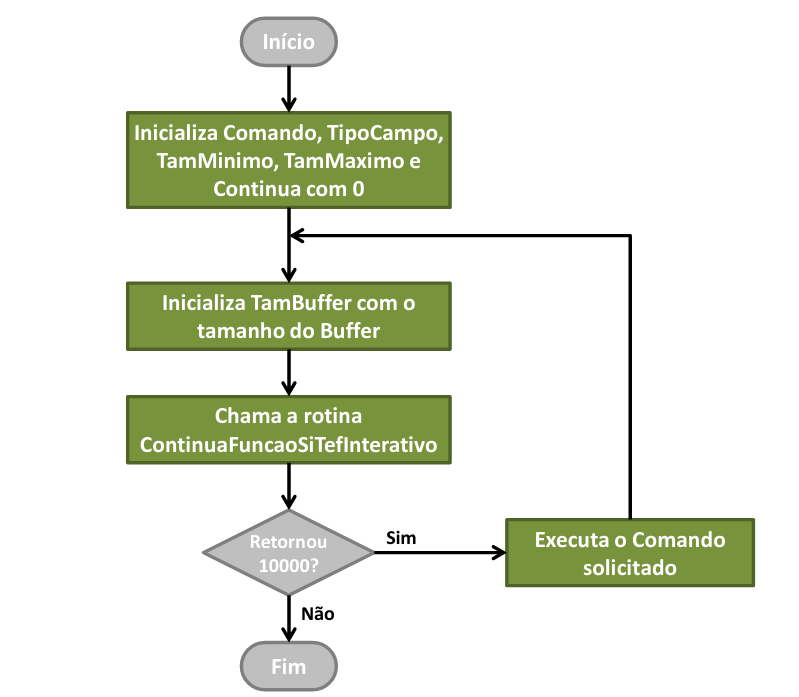

It is important to point out that the call that starts the iterative process (the one that is made after being received the value 10000 when calling a Payment, Management function, etc...) must be done with Command, FieldType, MinimumSize, MaximumSize and Continues containing the value 0 (zero).

Also note that the commercial automation must remain in a loop calling the routine described here until it receive a result other than 10000 or that the automation itself gives up continuing the process, as per shown below:

If the automation wishes to end the collection process, it must necessarily call the routine ContinuaFuncaoSiTefInterativo passing –1 (minus one) in the Continue field. If the collection process must continue, it must not modify any of the fields filled in by CliSiTef except the Buffer which, in the new call, must contain the collection result (if Command different from 0) or the original data if Command came with 0. Also note that even if the Buffer contains a field collected by the automation, its size must be the recommended by this document as it will contain, upon return, new data provided by the routine.

Note that the Buffer field may have been filled by the routine with some data to be memorized, displayed on the display or other reason, as specified in the description of each command that the automation application must handle.

IMPORTANT: It is mandatory that the automation ALWAYS collects fields that cannot be handled by it, that is, if it receive some code in pinpad error that they are unaware of or do not wish to deal with, that the information is captured by the operator typing the requested information.

3.1 Command code table#

Below we present the possible values for the Command parameter and the action that the application must perform upon receiving it. It is important that commercial automation handles all commands in this table.

| Command | Description |

|---|---|

| 0 | It is returning a value to, if desired, be stored by automation |

| 1 | Message for operator display |

| 2 | Message for customer display |

| 3 | Message for both displays |

| 4 | text that should be used as title in the menu presentation (see command 21) |

| 11 | You must remove the message displayed on the operator display (command 1) |

| 12 | You must remove the message displayed on the customer's display (command 2) |

| 13 | Must remove message displayed on operator and customer display (command 3) |

| 14 | You must clear the text used as title in the menu presentation (command 4) |

| 15 | Header to be displayed by the application. Refers to the display of additional information that some transactions need to show on the screen. An example is the Bank Correspondent Loan transaction, which at a certain point requires information to be shown to the customer detailing the loan being contracted (such as Amount of the due installment, etc.). |

| 16 | You must remove the header displayed by the 15. |

| 20 | It must present the text in Buffer, and obtain a YES/NO answer. In the return, the first character present in Buffer must contain 0 if confirmed and 1 if cancelled |

| 21 | It must present a menu of options and allow the user to select one of them. In the call, the Buffer parameter contains options in the format 1:texto;2:texto;...i:Texto; ... The application routine must present the options in the way it wishes (it is not necessary to include the indices 1,2, ...). After the selection made by the user, return in Buffer the index i chosen by the operator (in ASCII) |

| 22 | You must display the message in Buffer, and wait for a key from the operator. It is used when you want the operator to be notified of a message displayed on the screen. |

| 23 | This command indicates that the routine is asking the application whether it wants to interrupt the data collection process or not. This code occurs when CliSiTef is stopping a peripheral and allows the automation to interrupt this access (for example: waiting for a card to pass through the reader or for the customer to enter a password) Note: It is important that the “Commercial Automation Application” does not place “delays” when handling this command. At this point, some device (pinpad, barcode reader...) is carrying out some processing (reading card/barcode, collecting password) and a “delay” causes delays in accessing data from the device, which may not be more available resulting in data loss and communication errors. |

| 29 | Analogous to the 30 command, however, a field must be collected that does not require intervention from the cashier, that is, it does not need to be typed/shown on the screen, but rather passed directly to the library by automation. < br /> An example is the payment methods that some transactions require to identify which type of payment is being used. The amount to be collected refers to the field indicated in FieldType, whose size is between SizeMinimum and SizeMaximum. The field must be returned in Buffer |

| 30 | A field whose size is between SizeMinimum and SizeMaximum must be read. The read field must be returned in Buffer. |

| 31 | The number of a check must be read. Collection can be done by reading the CMC-7, typing the CMC-7 or typing the first line of the check. Upon return, it must be returned to Buffer: “0:” (typing the first line of the check), “1:”(CMC-7 Reading) or “2:”(CMC-7 Typing), followed by the number collected manually or by reading/typing the CMC-7, respectively. When the first line of the check is collected manually, the format is as follows: Clearing (3), Bank (3), Agency (4), C1 (1), Current Account (10), C2 (1), Check Number (6) and C3 (1), in that order. Note that these fields are those at the top of a check and in the order presented. We suggest that an interface be presented during the collection that allows the operator to identify and properly enter this information so that the query is not made with incorrect data, returning a check with problems as good |

| 34 | A monetary field must be read, that is, it accepts the cent delimiter and returned in the Buffer parameter. |

| 35 | A bar code must be read or it must be collected manually. In the return Buffer must contain “0:” or “1:” followed by the bar code collected manually or by the reader, respectively. It is up to the application to decide whether the collection will be manual or through a reader. If manual collection is required, it is recommended to follow the procedure described in the ValidaCampoCodigoEmBarras 4 routine in order to treat a bar code in the most generic way possible, leaving the automation application independent of future changes that may arise in the bar formats.< br /> When returning from Buffer, “2:” can also be passed, indicating that the collection was canceled, but the flow will not be interrupted, so in the case of multiple payments, all previously collected documents will be maintained and the flow resumed, allowing such payments to be made. |

| 41 | Analogous to Command 30, but the field must be collected in a masked way. |

4 See Checking the integrity of a bar code for more information.

| Command | Description |

|---|---|

| 42 | Identified menu. It must present a menu of options and allow the user to select one of them. In the call, the Buffer parameter contains the options in the format classe \| 1:texto:código:tipo; :texto:código:tipo;...i:Texto:código:tipo;.The application routine must present the options in the way it wants (it is not necessary to include the indexes 1,2, ..., nor field codes, type and class) and after the selection made by the user, return in Buffer the index i chosen by the operator (in ASCII). The code of options is the identification (Table of payment method codes, settings and menus) of the option field, it can be used to identify the chosen option. Within each “class” there is the coding of “types”, and each pair (class, type) indicates the nature of the option. Initially, only identification for payment methods was implemented. The idea is to add codes that identify menu options to enable the POS to identify these options without the operator's assistance. Classes: 0: Class not defined 1: Payment method, types below: - 1: Cash - 2: Check - 3: Debit - 4: Credit - 5: Withdrawal - 6: Another way The other menus are not identified. Unidentified menus receive a zero value in these fields, indicating that there has not yet been a need to classify them. Option classes aim to define a context for which the code that identifies the type of option is determined. Thus, an option in the menu is always identified based on the option type and option class pair. This command is used when the additional parameter ItemMenuIdentified is used (Enabling special configurations). In this case, the 21 command (menu collection) will be replaced in most cases, and the application must be prepared to handle both commands when this parameter is enabled. |

3.2 Value table for FieldType#

Below we present the possible values for the FieldType field and their respective meanings 5:

5 See specific product documents for other field codes.

Fields marked with * indicate that they are used in one or more products.

Note that not all fields are returned in all transactions. Additionally, there are fields that are only returned if the transaction was approved.

The automation application must ignore those fields that it does not want/do not know how to handle since, in In future versions of CliSiTef, new fields may be made available. Note that the correct way to ignore these fields is to execute the function defined in NextCommand or simply ignore the data returned to the application when NextCommand is 0.

Commercial automation is responsible for storing receipts for printing at the appropriate time, according to the current tax legislation.

In the case of Bank Correspondent or Administrative Functions, the printout of any receipt must be done at the moment they are made available for automation and information on whether they were printed correctly or is not passed by the function ContinuaFuncaoSiTefInterativo through the value 0 or -1, respectively, placed in Continue.

| FieldType | Description |

|---|---|

| -1 | There is no information that can/should be handled by automation |

| 0 | The routine is being called to indicate that it has just collected the transaction data and will start interacting with SiTef to obtain authorization |

| 1 | Transaction confirmation data. For environments with multiple servers, it will be returned in the following format:<Dados_Confirmacao>;<Indice_SiTef>;<Endereco_SiTef> |

| 2 | Informs the SiTef function code used in the message sent to the server. |

| 10 to 99 and 3000 to 3999 | Informs which option is selected in the transaction navigation menu, following the same coding used to define payment restrictions described in the item Restricting or enabling payment methods. |

| 100 | Payment method in the format xxnn. xx corresponds to the modality group and nn to the subgroup. Group: - 00: Check - 01 : Debit Card - 02: Credit Card - 03: Voucher card - 05: Loyalty Card - 98: Cash - 99: Other type card Subgroup: - 00: Cash - 01: Post-dated - 02: Installments with financing by the establishment - 03: Installments with financing by the administrator - 04: Cash with interest - 05: Credit - 99: Other type of payment |

| 101 | Contains the actual text of the payment method that can be memorized by the application if necessary. Describe in full the xxnn pair given out of 100. |

| 102 | Contains the descriptive text of the payment method that must be printed on the tax coupon (e.g.: T.E.F., Check, etc...) |

| 105 | Contains the date and time of the transaction in the format YYYYMMDDHHMMSS |

| 110 | Returns when a transaction is cancelled. Contains the cancellation modality in the xxnn format, following the same xxnn format as Field Type 100. The nn sub-group, however, contains the default value 00 as it is not collected. |

| 111 | Contains the actual text of the cancellation method that can be memorized by the application if necessary. Describes in full the xxnn pair given in 110. |

| 112 | Contains the descriptive text of the cancellation method that must be printed on the tax coupon (e.g.: T.E.F., Check, etc...). |

| 115 | Adjustment Mode |

| 120 | Buffer contains the check authentication line to be printed on the back of the check. |

| 121 | Buffer contains the first copy of the payment receipt (customer copy) to be printed on the fiscal printer. This copy, when possible, is reduced so that it takes up few lines on the printer. It can be a sales or administrative receipt. |

| 122 | Buffer contains the second copy of the payment receipt (cash copy) to be printed on the fiscal printer. It can be a sales or administrative receipt. |

| 123 | Indicates that the receipts that will be delivered in the sequence are of a certain type:

- PROOVANTE_COMPRAS = "00"

- PROVOVANTE_VOUCHER = "01"

- CHECK_PROOF = "02"

- PAYMENT_PROOF = "03"

- MANAGEMENT_PROOF = "04"

- CB_PROOF = "05"

- CELL RECHARGE_VOICE = "06"

- BONUS_RECHARGE_VOICE = "07"

- GIFT_RECHARGE_VOICE = "08"

- COMPROVANTE_RECARGA_SP_TRANS = "09"

- PROVOVANTE_MEDICAMENTOS = "10" |

| 125 | Voucher Code |

| 130 | Indicates, upon collection, that the field in question is the value of the cash change to be returned to the customer. When returning the result (Command = 0) it contains the value actually approved for the change |

| 131 | Contains an index that indicates which institution will process the transaction according to the table at the end of the document (up to 5 significant digits) |

| 132 | Contains an index that indicates the type of card when that type is identifiable, according to a table to be provided (5 positions) |

| 133 | Contains the SiTef NSU (6 positions) |

| 134 | Contains the NSU of the authorizing Host (20 positions maximum) |

| 135 | Contains the Authorization Code for credit transactions (15 positions maximum) |

| 136 | Contains the first 6 card positions (bin) |

| 137 | Balance payable |

| 138 | Total Amount Received |

| 139 | Entry Value |

| 140 | Date of first installment in ddmmyyy format |

| 143 | Tip amount |

| 144 | Return value |

| 145 | Payment amount |

| 146 | The routine is being called to read the Value to be canceled. If the automation application has this value, it can present it to the operator and allow him to confirm the value before passing it back to the routine. If it does not have this value, you must read it. |

| 147 | Amount to be canceled |

| 150 | Contains Track 1, when available, obtained from the LeCartaoInterativo function |

| 151 | Contains Track 2, when available, obtained from the LeCartaoInterativo function |

| 153 | Contains the customer's password captured through the LeSenhaInterativo routine and which must be passed the customized Software Express security lib to the commercial establishment in order to obtain the open password |

| 154 | Contains the new payment amount |

| 155 | Bonus card type |

| 156 | Institution name |

| 157 | Establishment Code |

| 158 | Authorizing Network Code |

| 160 | Original coupon number |

| 161 | Payment Coupon Identifier Number This is a counter (starting with value 0) of payments that occurred on the coupon. Example: If there were 6 payments in the Coupon, the values returned will be from [0] to [5]. |

| 170 | Installment Sale Qualified Establishment |

| 171 | Minimum Number of Installments – Establishment Installments |

| 172 | Maximum Number of Installments – Establishment Installments |

| 173 | Minimum Value Per Installment – Establishment Installments |

| 174 | Installment Sale Qualified Administrator |

| 175 | Minimum Number of Installments – Administrative Installment |

| 176 | Maximum Number of Installments – Administrative Installment |

| 177 | Indicates that the field is numeric (PBM) |

| 178 | Indicates that the field is alphanumeric (PBM) |

| 200 | Available balance, balance of the specific product (school, transport voucher) |

| 201 | Blocked Balance |

| 500 | Indicates that the field in question is the supervisor code. Automation can, if desired, validate the collected data, allowing the transaction flow to continue normally if an acceptable supervisor |

| 501 | Type of Document to be consulted (0 – CPF, 1 – CGC) |

| 502 | Document number (CPF or CGC) |

| 504 | Service Fee |

| 505 | Number of Installments |

| 506 | Post-dated date in ddmmyyy format |

| 507 | Captures whether the first installment is cash or not (0 – First cash, 1 – otherwise) |

| 508 | Interval in days between installments |

| 509 | Captures whether it is a closed month (0) or not (1) |

| 510 | Captures whether it is with (0) or without (1) post-dated guarantee with debit card |

| 511 | Number of CDC Installments |

| 512 | Credit Card Number Entered |

| 513 | Card expiration date |

| 514 | Card security code |

| 515 | Transaction date to be canceled (DDMMYYY) or to be reprinted |

| 516 | Document number to be canceled or reprinted |

| 517 | The routine is being called to read the Check Number as described in the command type corresponding to the value 31 |

| 518 | Item Code |

| 519 | Payment Plan Code |

| 520 | SiTef Original NSU (Cisa) |

| 521 | Identity document number (RG) |

| 522 | The routine is being called to read the Phone Number |

| 523 | The routine is being called to read the area code of a telephone with up to 4 digits |

| 524 | Value of the first installment |

| 525 | Value of other installments |

| 526 | Number of checks |

| 527 | Check expiry date |

| 529 | The routine is being called to read the Account Opening Date in the format (MMYYY) |

| 530 | Typed supervisor authorization |

| 531 | Special supervisor authorization |

| 532 | The routine is being called to read the amount of installments or checks |

| 533 | Additional sales data |

| 534 | Check issuer |

| 535 | The document paid for the transaction |

| 536 | CDL-Poa check consultation return records |

| 537 | Check city area code |

| 550 | Address |

| 551 | Address number |

| 552 | Address floor |

| 553 | Address set |

| 554 | Address block |

| 555 | Address zip code |

| 556 | Address neighborhood |

| 557 | CPF for AVS consultation |

| 558 | AVS query result |

| 559 | Number of pre-dated days |

| 560 | Number of Cycles |

| 561 | Occurrence Code |

| 562 | Store Code (EMS) |

| 563 | POS Code (EMS) |

| 564 | Returned Data (EMS) |

| 565 | Telephone Extension |

| 566 | RG Issuing Body |

| 567 | State where the ID was issued |

| 568 | ID issuance date |

| 569 | Operator Registration |

| 570 | Operator Name |

| 571 | Lecturer Registration |

| 572 | Name of Lecturer |

| 573 | Interest Percentage Applied |

| 574 | Authorizer Registration |

| 575 | Original Transaction Tax Coupon Date |

| 576 | Original Transaction Tax Coupon Time |

| 577 | Carnet details or EMS summary code |

| 578 | Differentiated miles code 1 |

| 579 | Value of differentiated miles 1 |

| 580 | Differentiated mile code 2 |

| 581 | Value of differentiated miles 2 |

| 582 | EMS External Code Type |

| 583 | EMS External Code |

| 587 | Code name of the cell phone authorizing institution |

| 588 | Cell phone authorizing establishment code |

| 593 | Check digit(s) |

| 594 | Zip code of the location where the terminal in which the operation is being carried out is located |

| 595 | Obsolete. SiTef NSU corresponding to the Recharge payment transaction with card |

| 596 | Obsolete. Nsu of the Authorizing Host corresponding to the Recharge payment transaction by card |

| 597 | Code of the Branch that responded to the cell phone recharge request |

| 599 | Network code authorizing cell phone recharge |

| 600 | Expiration date of the title/agreement in the format DDMMYYY |

| 601 | Amount Paid |

| 602 | Original Value |

| 603 | Added Value |

| 604 | Rebate Value |

| 605 | Payment Accounting Date |

| 606 | Name of the Title Assignor. It must be printed on the check when payment is made via this method |

| 607 | Document index, in the case of batch payment, from fields 600 to 604 that will follow |

| 608 | Payment method used in the banking correspondent role. It follows the same formatting rule as the number field 100 |

| 609 | Total value of titles actually paid in case of batch payment |

| 610 | Total value of unpaid titles in case of batch payment |

| 611 | NSU Banking Correspondent |

| 612 | Type of document: 0 - Collection, 1 - Title (Compensation form), 2 - Tax |

| 613 | Contains the details of the check used to pay bills in the following format: Clearing (3), Bank (3), Agency (4), Current Account (10), and Check Number (6), in that order. Note that the order is the same as that on the top line of the check without the check digits |

| 614 | NSU SiTef payment transaction |

|620| NSU SiTef of the original transaction (cancellation transaction)

|621| NSU Banking Correspondent of the original transaction (cancellation transaction)

|622| Benefit Value

|623| Code printed at the bottom of the CB receipt and used for re-printing/cancellation

|624| Paid barcode. Appears once for each document index (field 607). The format is the same as that used to enter the field, that is, 0:number or 1:number 625 Withdrawal receipt

|626| Bank number

|627| Agency

|628| Agency digit

|629| Account

|630| Account digit

|631| Cash value

|632| Amount by check

|633| Depositor's name

|634| Original Banking Correspondent document

|635| User key used to communicate with the Bank

|636| Unique sequence of the user's key in the Bank

|637| Correspondent store relationship agency code

|638| CB Check Number

|639| Bill number

|640| Agreement Number

|641| Statement Start Date (DDMMYYY)

|642| Statement End Date (DDMMYYY)

|643| Calculation Period

|644| Federal Revenue Code

|645| Gross Revenue Value

|646| Percentage Applied

|647| Main value

|648| Fine Value

|649| Interest Value

|670| PinPad Data

|700| ValeGás operator

|701| ValeGás product

|702| ValeGás number

|703| Reference number

|704| GPS code

|705| GPS Competency

|706| Contributor Identifier

|707| INSS value

|708| Value Other Entities

|709| Allows Payment of Bills With Cash (0 – Does not allow; 1 – Allows)

|710| Allows Payment of Bills by Check (0 – Does not allow; 1 – Allows)

|711| Allows Payment of Bills With TEF Debit (0 – Does not allow; 1 – Allows)

|712| Allows Payment of Bills With TEF Credit (0 – Does not allow; 1 – Allows)

|713| Payment Methods used in the Generic Payment transaction

|714| Withdrawal Value

|715| Request number

|716| CB Deposit Limit Amount

|717| CB Withdrawal Limit Value

|718| Withdrawal Limit Value for CB Payment

|719| ValeGás product value

|722| Minimum payment amount

|723| Customer Identification, only for Carrefour receipt

|724| Selling Credit in Installments with an Enabled Plan

|725| Sell Credit with Enabled Cash Authorization

|726| Sell Credit with Authorization Installment with Enabled Plan

|727| Boleto Sale Enabled

|729| Maximum payment amount

|730| Maximum Number of Payment Methods, 0 for no limit

|731| Payment Type Enabled, repeats “n” times, where “n” is the number of payment methods enabled:

- 00 Cash

- 01 Check

- 02 TEF Debit

- 03 TEF Credit

- 04 Prepaid Gift Card) Carrefour

- 05 Carrefour Bonus Card

- 06 Carrefour Card

- 07 Withdrawal for payment <br/ >- 08 Withdrawal

- 09 DCC Carrefour

- 50 TEF Card

- 77 Reserved Field

|732| Data to be sent for the Payment Type (Field 730) previously returned, repeats “n” times, where “n” is the number of data to be sent for the respective Payment Type:

- 00 Reserved Field

- 01 Check Entry Type

- 02 Check Data

- 03 Destination Network

- 04 SiTef NSU of the TEF transaction

- 05 TEF transaction SiTef date (unused, future use)

- 06 TEF transaction Company (Store) Code

- 07 TEF transaction Host NSU

- 08 Date of the TEF transaction Host (Field 105 CliSiTef)

- 09 Origin (Establishment) Code of the TEF transaction

- 10 Service Z of the TEF transaction

- 11 Authorization Code of the transaction of TEF

- 12 Check Value

|734| Minimum sales limit for flexible promotions, with 12 digits with the last 2 digits referring to decimal places

|738| Suggested value for the selected product.

|739| Preferred Customer

|750| CB Easy Pay Value

|751| Fare Value Pague Fácil CB

|from 800 to 849| The entire range from 800 to 849 is reserved for the return of GerPdv

|950 |CNPJ NFCE Accreditor

|951 |NFCE Flag

|952 |NFCE authorization number

|953 |SAT Accreditation Code

|1002| Card Expiry Date

|1003| Cardholder Name

|1010| Quantity of medicines - PBM

|1011| Drug index – PBM

|1012| Drug code – PBM

|1013| Authorized quantity – PBM

|1014| Maximum consumer price – PBM

|1015| Recommended consumer price – PBM

|1016| Sale price in the pharmacy – PBM

|1017| Reimbursement value at the pharmacy – PBM

|1018| Replacement value at the pharmacy – PBM

|1019| Subsidy value of the agreement – PBM

|1020| CNPJ agreement – PBM

|1021| Discount plan code – PBM

|1022| Have a prescription – PBM

|1023| CRM – PBM

|1024| UF – PBM

|1025| Product description* - PBM

|1026| Product code – PBM

|1027| Product quantity – PBM

|1028| Product value – PBM

|1029| Medical prescription date - PBM

|1030| PBM authorization code

|1031| Quantity reversed – PBM

|1032| PBM chargeback code

|1033| Recommended consumer cash price – PBM

|1034| Recommended price consumed for payroll deduction – PBM

|1035| Pharmacy replenishment percentage – PBM

|1036| Replacement commission – PBM

|1037| Authorization Type – PBM

|1038| Partner code – PBM

|1039| Name of the partner – PBM

|1040| Type of PBM Medicine (01–Medicine, 02-Handling, 03-Special Handling, 04-Perfumery)

|1041| Description of the Medicine – PBM

|1042| Condition for sale: If 0 is mandatory to use Functional Card price (PF) If 1 can sell for a price lower than the PF price

|1043| Functional card price

|1044| Price charged – PBM

|1045| Drug Status – PBM

|1046| Quantity prescribed – PBM

|1047| Reference – PBM

|1048| PBM sales indicator (0-Product card sale 1-Product cash sale)

|1051| Date of birth

|1052| Mother's name

|1058| Additional data – ACSP

|1100| Analytical log CHECKCHECK

|1101| ACSP Analytical Log

|1102| SERASA analytical record

|1103| ACSP analytical screen image

|1104| SERASA analytical screen image

|1105| Reason for cancellation – ACSP

|1106| Query type – ACSP

|1107| CNPJ Affiliated Company

|1108| Administrator code

|1109| Telecheque table data - ACSP

|1110| Driver registration – Fuel Card

|1111| Vehicle plate – Fuel Card

|1112| Mileage – Fuel Card

|1113| Quantity of liters – Fuel Card

|1114| Main fuel – Fuel Card

|1115| Fuel products – Fuel Card

|1116| Host Product Code – Fuel Card

|1117| Hour Meter – Fuel Card

|1118| Credit Line – Fuel Card

|1119| Type of Goods – Fuel Card

|1120| Branch – Fuel Card

|1121| Decimal places of unit prices – Fuel Card

|1122| Maximum quantity of products for sale

|1123| Product code size – Fuel Card

|1124| Vehicle code – Fuel Card

|1125| Company Name – Fuel Card

|1126| Decimal places of quantity – Fuel Card

|1128| List of Questions – Fuel Card

|1129| Allows Product Collection – Fuel Card

|1131| Limit Code

|1132| Number of Holders

|1133| Company Opening Date (DDMMYYY)

|1134| Cardholder Name

|1135| Address complement

|1136| City

|1137| state

|1152| Values Menu - SPTrans

|1160| Product with Face Value – Gift

|1190| Embossment (last 4 digits) of the Card

|1200| Total previous queries

|1201| Accumulated value from previous queries, containing 2 decimal digits but without the decimal character.

|1202| Total number of consultations carried out on the day.

|1203| Accumulated value of consultations on the day, containing 2 decimal digits but without the decimal character.

|1204| Total number of post-dated check consultations carried out in the period.

|1205| Accumulated value of post-dated checks, containing 2 decimal digits but without the decimal character.

|1206| Salesperson (User) - PBM

|1207| Password – PBM

|1208| Return Code – PBM

|1209| Source – PBM

|1321| Canceled Transaction Authorizing Host NSU

|2006| Encryption type

|2007| MasterKey Index

|2008| Encryption key

|2009| Card password

|2010| Authorizer response code

|2011| Network bin

|2012| CHIP serial number

|2013| CHIP control register

|2014| Common balance, common pass balance

|2015| Gift card PAN

|2017| First due date

|2018| Amount

|2019| Amount financed

|2020| Fine percentage

|2047| Late payment interest

|2048| TAC (Administration fee)

|2053| Menu (product) selected Visanet

|2054| CDC Credit Type (1 – CDC Product; 2 – CDC Service)

|2055| Date/Time Sitef (Location)

|2056| Day of the week Sitef (Local)

|2057| Sitef Date/Time (GMT)

|2058| Sitef Day of the Week (GMT)

|2059| Payment Method Data - SPTrans

|2064| Cash payment amount

|2065| Check query code (Generic EMS)

|2067| Authorizer message to be displayed along with the values menu (If the terminal allows)

|2078| Service code

|2079| Service value

|2081| Product Menu

|2082| Our number

|2083| Total value of the product containing the decimal separator (“,”) and two decimal places after the comma.

|2086| Product Code - ValeGas

|2087| Statement of deadlines: 0: No; 1: Yes|

|2088| Total/Partial Cancellation: 0: Partial; 1: Total|

|2089| Invoice identification number.|

|2090| Card type Read:

- 00 – Magnetic (Traditional magnetic cards and Samsung Pay in “MST – Magnetic Secure Transmission” mode)

- 01 - VISA Cash coin purse over TIBC v1 <br/ > - 02 - VISA Cash currency exchanger over TIBC v3

- 03 - EMV with contact

- 04 - Easy-Entry over TIBC v1

- 05 - Contactless chip simulating stripe

- 06 - Contactless EMV (Traditional cards, contactless stickers and bracelets, in addition to mobile solutions such as Apple Pay, Google Pay, Samsung Pay in “NFC – Near Field Communication” mode, among others)

- 99 – Typed

|2091|Status of last card reading

- 0 - Success.

- 1 - Error subject to fallback.

- 2 - Required application not supported.|

|2093| Attendant code |

|2103| Indicates whether it was an offline transaction: 1: Yes|

|2109| Temporary password |

|2124| Cellphone Recharge fee value (via Banking Correspondent. Example: CB Bradesco) |

|2125| Installment number (2 characters) (Hotcard)|

|2126| Transaction sequence (6 characters) (Hotcard) |

|2301| Footer of proof of establishment |

|2320| Depositor Code – CB|

|2321| Customer Code |

|2322| Card Sequence – CB|

|2323| Via Card - CB|

|2324| Extract Type – CB|

|2325| Transfer limit value - CB|

|2326| Limit value for collecting CPF/CNPJ – CB|

|2327| Owner's CPF/CNPJ – CB|

|2328| CPF/CNPJ of the Bearer – CB|

|2329| Owner document type - CB|

|2330| Bearer document type - CB|

|2331| Indicates whether payment with CB card is allowed |

|2332| Transfer Value |

|2333| Transaction identification |

|2334| Pin Code|

|2355|When returned, it acts as a “hint” for the format of the next field that will be collected. It is normally accompanied by the zero command (0 – return value for use by automation). It assumes the following values:

- A Alphabetic

- AN Alphanumeric (ans)

- LN Unaccented letters and numbers

- N Numeric

- Vx Value with x decimal places

- Y Yes/No

- M Menu

- Mc Menu with confirmation|

|2361| Indicates that a debit transaction was carried out to pay the carnet |

|2362| Returned right after the bin query transaction. The value 1 indicates that the authorizer is capable of treating conventional debit transactions differently from debit transactions for bill payments |

|2363| Indicates that a credit transaction was carried out to pay the carnet |

|2364| Returned right after the bin query transaction. The value 1 indicates that the authorizer is capable of treating conventional credit transactions differently from credit for bill payment.

|2369| Points to be redeemed (numeric without decimal place).|

|2421| Informs whether the additional customer data collection function is enabled (0 or 1)

|2467| Date in DDMMY Format Positive Confirmation |

|2468| Date in DDMM Format Positive Confirmation |

|2469| Date in MMAA Format Positive Confirmation |

|2470| Floating Point Field |

|2601| Message for pinpad|

|2602| Hash Seed |

|2603| Card reading method using function 431.|

|2699| Sends additional GIFT Activation/Recharge information, returned by the SQCF host, to Automation

|2925| Credit Card Recharge Value |

|2965| Debit Card Recharge Value |

|2974| Sale in Installments via Qualified Credit |

|2975| Minimum number of installments for credit |

|2976| Maximum number of installments for credit |

|3481| Menu (managerial) AVS Consultation|

|3988| Credit Menu |

|3989| Credit Simulation Menu |

|4000| Pre-Authorization Status – PBM|

|4001| CRF – PBM |

|4002| UF do CRF – PBM |

|4003| Type of sale – PBM|

|4004| Total PBM value |

|4005| Cash value PBM |

|4006| PBM card value |

|4007| Our PBM number|

|4008| Discount percentage granted by the administrator (2 decimal places) |

|4016| Gross price – PBM|

|4017| Net Price – PBM|

|4018| Amount receivable from the Store, in cents – PBM|

|4019| Batch number generated by the Center – PBM|

|4020| Total amount receivable from the store – PBM|

|4021| Total amount receivable from the store – PBM|

|4022| Sum of Operation values – PBM|

|4023| Operator name – PBM|

|4024| Name of the partner company – PBM |

|4025| Number of dependents – PBM|

|4026| Dependent code – PBM|

|4027| Dependent’s name – PBM|

|4028| Amount receivable from the partner – PBM|

|4029| Total discount value, in cents |

|4030| Total net value, in cents - PBM|

|4031| PBM Selected Operator Code (must be saved for later sending in other transactions)

|4032| Free data return field relating to PBM transactions.|

|4033| PBM Document Type (0 = CRM, 1 = CRO)|

|4034| Redemption Data - Bonus|

|4039| PBM Response Code (0 = Ok, <>0 = error)|

|4040| PBM Fractional Product (0 = no, 1 = yes)|

|4041| Patient PBM ID (-1 = others, 00 = holder, 01 = dependent) |

|4043| PBM ID Revenue (revenue registered by the company) |

|4044| Revenue item PBM ID (revenue item registered by the company) |

|4045| Recipe continuous use (0 = no, 1 = yes)|

|4046| PBM Manipulated Product (active ingredients) |

|4047| PBM Manipulated Product Original Value |

|4058| Approved Product Value with Discount |

|4076| Store Identification |

|4077| Contains the FEPAS NSU (20 positions maximum) |

|4095 |CPF/CNPJ of the Beneficiary|

|4096 |Sacador CPF/CNPJ|

|4097 |Payer's CPF/CNPJ|

|4100| Communication error (for example: timeout) The Buffer contains the Error code.

Examples:

[TCP:R:10054] An existing connection was forced to be canceled by the remote host.

[TCP:C:10060:TO] A connection attempt failed because the connected component did not respond correctly after a period of time

or the established connection failed because the connected host did not respond.

|4125| Customer Coupon available, for reprinting or consultation, in the SiTef database |

|4126| Establishment Coupon available, for reprinting or consultation, in the SiTef database

|4127| Number of days that coupons will be available in the SiTef database

3.1 Event Table, also returned in TypeField#

During the transaction, CliSiTef may report the occurrence of certain events.

These events are returned in the TipoCampo parameter of the ContinuaFuncaoSiTefInterativo routine or ContinuaFuncaoSiTefInterativoA, as shown in the table below.

| FieldType | Description |

|---|---|

| 5000 | Indicates that the library is waiting to read a card |

| 5001 | Indicates that the library is waiting for the user to enter the password |

| 5002 | Indicates that the library is waiting for the user to enter positive confirmation data |

| 5003 | Indicates that the library is waiting to read the single ticket |

| 5004 | Indicates that the library is waiting for the single ticket to be removed |

| 5005 | Indicates that the transaction has been completed |

| 5006 | Confirm Payee Data |

| 5007 | SiTef Connected |

| 5008 | SiTef Connecting |

| 5009 | Query OK |

| 5010 | Signature Harvest |

| 5011 | New Product Collection |

| 5012 | Confirm Operation |

| 5013 | Confirm Cancellation |

| 5014 | Confirm Total Value |

| 5015 | Single Ticket Recharge Completion |

| 5016 | Reserved |

| 5017 | Waiting for card reading |

| 5018 | Waiting to enter password on PinPad |

| 5019 | Waiting for chip processing |

| 5020 | Waiting for card removal |

| 5021 | Awaiting confirmation of operation |

| 5027 | Cancellation of card reading |

| 5028 | Cancelling password entry on PinPad |

| 5029 | Cancellation of card processing with CHIP |

| 5030 | Card removal cancellation |

| 5031 | Cancellation of operation confirmation |

| 5036 | Before reading the magnetic card |

| 5037 | Before reading the CHIP card |

| 5038 | Before removing the CHIP card |

| 5039 | Before collecting the password on the pinpad |

| 5040 | Before opening communication with the PinPad |

| 5041 | Before closing communication with PinPad |

| 5042 | Must lock resources for PinPad |

| 5043 | Should free up resources for PinPad |

| 5044 | After opening communication with PinPad |

| 5049 | Timeout with SiTef |

| 5050 | Updating tables for offline transactions. The content of this field varies depending on the transaction being carried out. |

| 5051 | Indicates that you have collected a password on the pinpad. |

| 5052 | Indicates that you have processed a chip card (GoOnChip) |

| 5053 | Indicates that you removed the chip card from the pinpad reader |

| 5054 | Indicates that you have delivered sensitive data (Specific for POS PAX) |

| 5055 | Indicates that it is updating tables in pinpad (Event returned for each record sent to pinpad) |

| 5056 | Indicates that you are sending files to Sitef |

| 5057 | Indicates the start of sending fields with sensitive data. |

| 5058 | Indicates end of sending fields with sensitive data |

| 5059 | Indicates that it is waiting for card reading (Mode 29) |

| 5060 | Reserved |

| 5061 | Reserved |

| 5062 | Indicates the start of sending fields related to products (fuels, medicines, etc.) |

| 5063 | Indicates End of sending fields related to products (fuel, medicines, etc.) |

| 5074 | Indicates that a paper signature must be obtained when paying with a chip card |

| 5501 | Start of a Banking Correspondent type transaction. |